Why Dollar Cost-Averaging Can Be a Wise Strategy for Regret-Averse Investors (and We’re All Regret-Averse)

Investors with cash destined for stocks often apply dollar-cost averaging (DCA). They divide the cash into equal segments and convert one segment at a time from cash to stocks according to a predetermined schedule. The alternative to this strategy is lump-sum (LS) investing, whereby investors convert the entire amount of cash into stocks all at once.

Proponents of DCA offer two rationales for its superiority over LS investing. First, DCA may boost returns. Second, DCA may carry lower risk.

I believe both investing rationales are faulty, yet I think DCA can be a wise technique for regret-averse investors. Concepts underlying the combination of faulty and wise include framing shortcuts and errors and regret aversion.

Framing Shortcuts and Errors

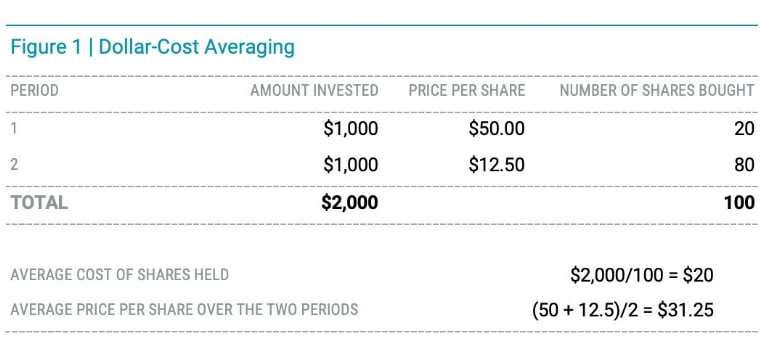

Let’s begin with the first rationale that DCA may boost returns. As illustrated in Figure 1, imagine an investor with $2,000 in cash to invest in stocks. She applies DCA by dividing her cash into two parts of $1,000 each, investing the first amount in period 1 and the second amount in period 2.

In period 1, the price per share of stock is $50, while the price per share in period 2 turns out to be $12.50. Framing is a cognitive shortcut that can turn into a cognitive error.

Framing the investment in the “rational” standard finance way, the investor started with $2,000. She now has 100 shares worth $12.50 apiece for a total of $1,250, a clear loss.

Framing the investment in the “normal” behavioral finance way, as DCA advocates would have it, the investor bought the shares at an average cost of $20, whereas the average price per share over the two periods was $31.25. She has a clear gain. Indeed, the investment shows a gain in all cases except when the stock price never changes.

Let’s turn now to the second rationale for the superiority of DCA over LS investing, that it may entail lower risk.

At period 1, a DCA investor has $1,000 in stocks and $1,000 in cash. Her risk is lower than that of a LS investor with $2,000 in stocks because the risk of cash is lower. But once period 2 arrives, the DCA investor has $2,000 in stocks, so she now bears the same risk as the LS investor. The only real difference here is that the DCA investor is now one period older. Does older age make it easier for the DCA investor to bear risk? Probably not.

Moreover, a prominent feature of DCA investing is that it is recommended with equal force to investors with cash to be converted into stocks and investors with stocks to be converted into cash. In LS investing, an investor bears less risk if she converts $2,000 of stocks into cash now, rather than convert only $1,000 of stocks into cash now and keep $1,000 in stocks for another period, as in DCA investing.

Risk Reduction and Regret Aversion

So, risk reduction cannot be a valid rationale for DCA investing. The real benefit of DCA investing is in reducing regret. Regret is the painful emotion we experience when we find, too late, that another choice would have brought better outcomes. Pride is the pleasurable emotion that stands opposite regret. Consider the regret potential of converting the entire $2,000 of cash into stocks today. How much regret would you feel if stocks plunged tomorrow? Your regret would be less if you converted only $1,000 today because you could contemplate the pride you would feel by investing the next $1,000 at a lower stock price. Regret aversion is quite different from risk aversion. Indeed, the correlation between the two versions is zero. My own attitudes illustrate the difference between the two.

Years ago, I wanted to transfer a substantial amount of money in my retirement savings account from one mutual fund company to another to benefit from its lower fees. Making the transfer involved having the human resources department certify my completed forms and then sending them to the mutual fund company to which I wanted the money transferred.

In turn, that mutual fund company sent the forms to the mutual fund company from which the money came. That mutual fund company then sent a check by regular mail to the other mutual fund company, which deposited the check in the proper account upon its arrival. The check might have taken seven to 10 days to reach its destination.

What if the stock market had zoomed while my money was in cash? Would I have been able to bear the pain of regret?

I alleviated my potential regret by a method analogous to DCA investing. I split the total amount into four transfers, initiating each one after the earlier one was completed. I reasoned that the stock market was likely to move up during some of the four transfers, which imposed regret, and move down during others, which bestowed pride.

More recently, I made a similar transfer after procrastinating and contemplating potential regret. This time I arranged for a single transfer of the full amount, analogous to LS investing, vowing to feel no regret if the stock market increased while my money was in cash and no pride if the market decreased during that time.

As it happened, the stock market decreased by 2% while my money was in cash. Ever since, I struggle to suppress my unearned pride.

The usual method by which cash from earnings is converted into stocks in 401(k)-type accounts resembles DCA investing. Cash is converted into stocks every pay period. Ask yourself, if given the choice, would you be willing to convert the full annual amount in one lump sum in the middle of the year? Regret aversion might give you pause.

Now consider required minimum distribution (RMD) withdrawals. You can withdraw the entire annual amount in one lump sum or withdraw it monthly in equal amounts. Do you prefer one withdrawal method to the other? Does regret aversion affect your choice?

What should financial advisers do when clients decide to convert a large amount of cash into stocks, but hesitate because they think stocks are overvalued and ready to plummet?

DCA investing is like dipping your toes in the pool one at a time, while LS investing is like plunging headfirst into the pool.

Anticipated regret might cause clients to linger at the edge of the pool, hesitant to invest. Advisers can try to educate investors, urging them to overcome their regret aversion and invest the entire amount in one lump sum. But if clients resist, advisers may be wise to offer DCA investing as a second-best method, guiding clients to dip their toes into the pool one at a time.

Similar guidance can apply in similar situations. For example, when clients have a large position in a single stock and are contemplating a transition into a diversified mutual fund or ETF but are hesitant because they think the price of their single stock could skyrocket at any moment.

Investing, after all, is really a matter of trade-offs. And a plan that may improve expected outcomes while simultaneously reducing painful regret may be a fine trade-off in the long run.

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments portfolio.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.