Where the U.S. Dollar Stands as a Reserve Currency

The U.S. dollar (USD) has long been the world’s most widely used currency, playing a critical role in global trade and as a store of value for central bank reserves. But we occasionally hear claims that the dollar’s dominance may be in jeopardy.

These predictions tend to center around potential shorter- and longer-term trends that could increase demand for international currencies, such as continued growth from China leading to a rise in demand for the renminbi (RMB) or tighter integration of EU debt markets leading to the euro (EUR) becoming a more attractive reserve currency alternative.

Where these predictions may catch investor attention is that a significant decline in demand for the dollar could mean a similarly significant fall in its value versus other currencies, which would have implications for investments and the consumption of foreign goods. For example, a weakening USD could be a tailwind for unhedged international equity investments held by U.S. investors.

So, are we seeing chinks in the armor of the dollar’s dominance as the world’s leading reserve currency? The data suggests that’s likely not the case.

U.S. Dollar Continues to Hold a Big Lead in Share of Global Reserves

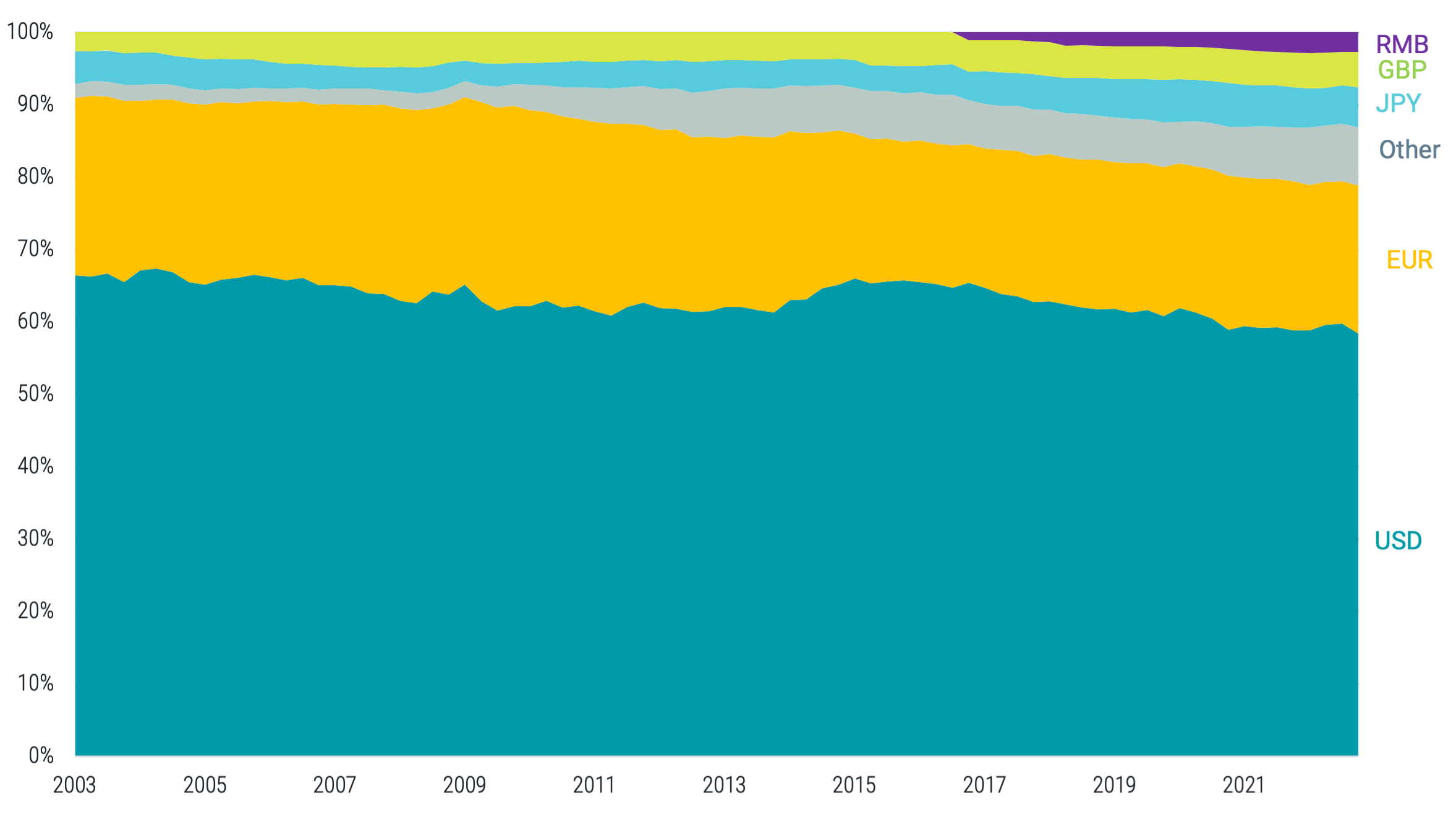

Figure 1 provides the composition of global foreign exchange reserves by currency over the last 20 years.

Figure 1 | Composition of Global Foreign Exchange Reserves by Currency

Data from 2003 – 2022. Source: Currency Composition of Official Foreign Exchange Reserves (COFER), International Financial Statistics (IFS). EUR = euro, JPY = Japanese yen, GBP = British pound sterling and RMB = renminbi.

While the USD’s share of global reserves has declined modestly, it remains the world’s preferred reserve currency, accounting for almost 60% at the end of 2022. This hasn’t been a straight-line decline. In the early portion of the 2010s — following the Great Financial Crisis (GFC) period — reserves allocated to the USD fell to nearly 60% (slightly higher than today) before rising to 66% in 2015 (similar to the peak levels seen in the early part of the sample period).

The gap between the share of USD and EUR, the second most-used reserve currency, has also seen little change over these 20 years (40% on average). After being in line with the average as recently as the third quarter of 2022, this gap was just below the period average at the end of 2022.

With no other currency at more than a 6% share of global reserves, there’s little evidence that any currency has gained meaningful ground on the USD over the last 20 years. We are far from seeing the USD surpassed as the leading reserve currency.

Further, investors should recognize that periods of decline in the share of global reserves might not necessarily mean that currency will depreciate against other major currencies.

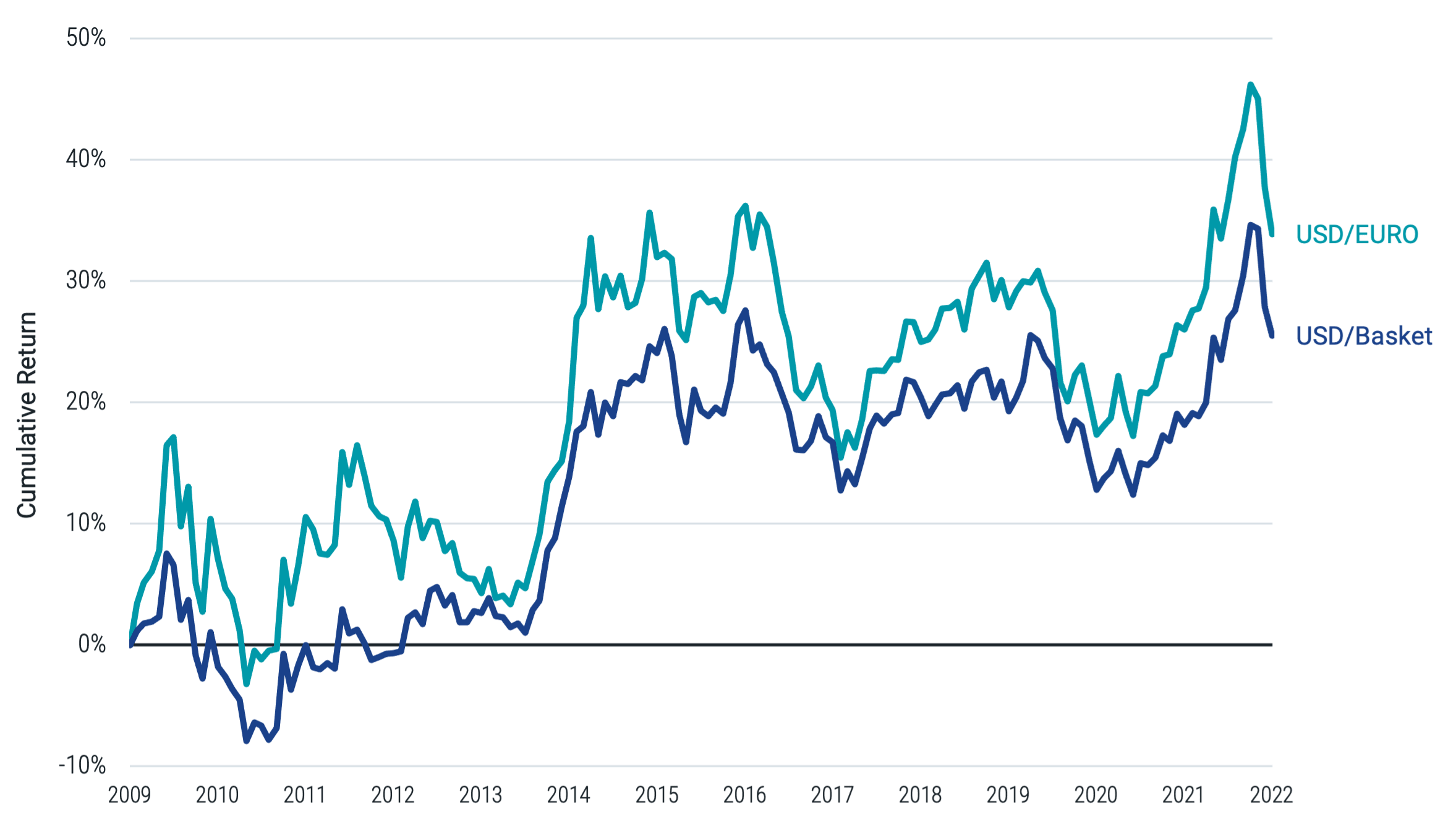

During the period following the GFC (2010-2022), when the USD slightly lost its share of global reserves, it also strengthened by more than 30% versus the euro as well as more than 20% versus a basket of other leading foreign currencies. See Figure 2.

Figure 2 | The Dollar Strengthened Over a Period of Decline in Share of Global Reserves

Data from 12/31/2009 – 12/31/2022. Source: Bloomberg. “USD/Basket” is the Bloomberg Dollar Spot Index, which tracks the performance of a basket of 10 leading global currencies versus the U.S. dollar.

While the point remains that USD’s value is affected by many more considerations than its share of global reserves, it’s worth noting that some of the USD’s gains since 2010 were lost in the final quarter of 2022. We’ve seen that continue through the beginning of 2023.

Other Measures Tell a Similar Story of the Dollar’s Dominance in the Global Economy

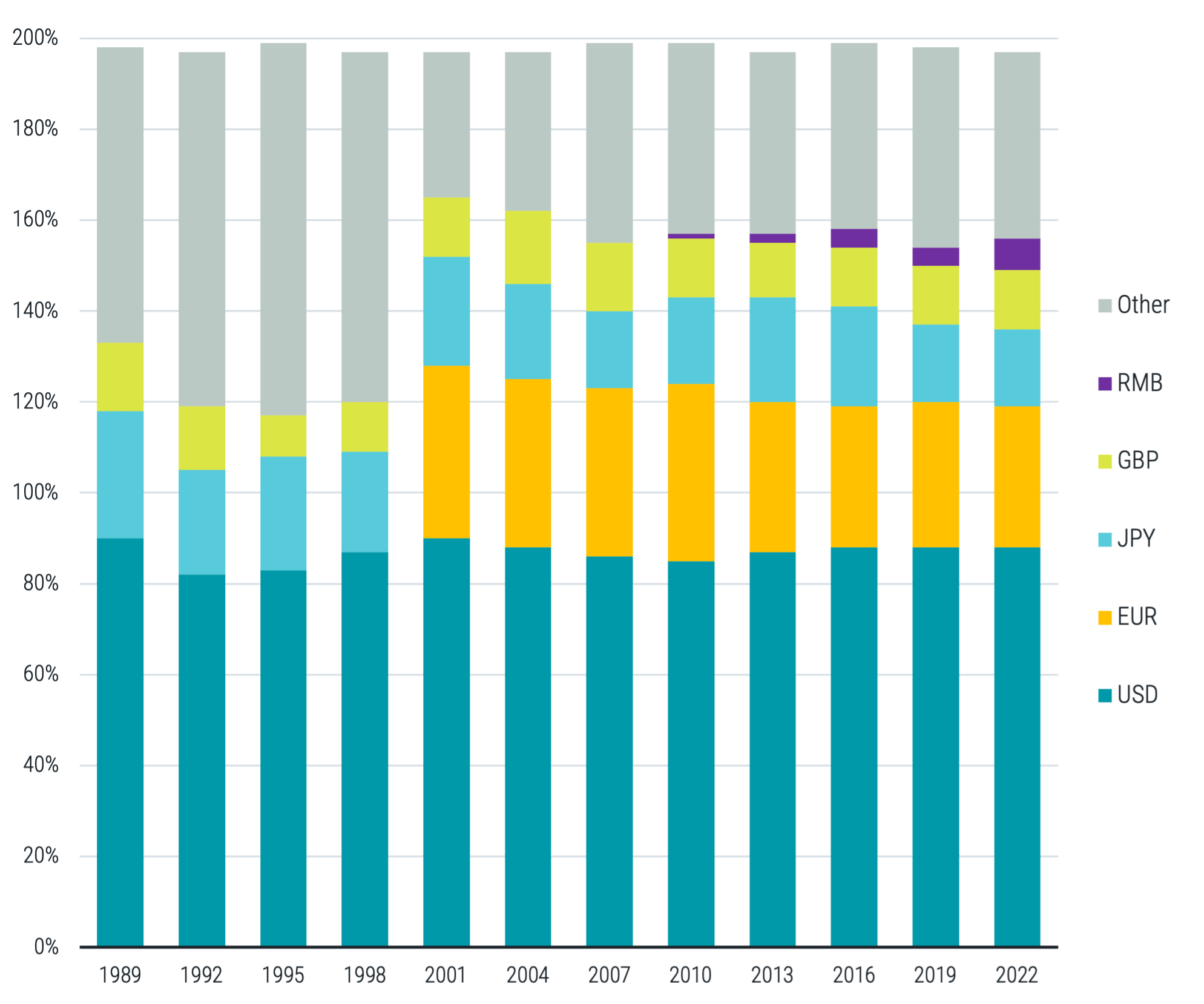

In Figure 3, we examine another gauge of USD usage by looking at the makeup of foreign exchange transactions by currency.

Figure 3 | Share of Foreign Exchange Transactions by Currency

Data from 1989 to 2022. Source: Triennial survey of turnover of OTC foreign exchange instruments by currency. Survey is conducted for the month of April of each year. Results may be less than 200% due to rounding.

Because there are two sides to a foreign exchange transaction (i.e., the currency bought and the currency sold), totals for each period sum up to 200%. What stands out is that the USD’s participation in foreign exchange transactions remained remarkably stable from 1989 to 2022. Neither the euro’s introduction in 1999 nor the growth in usage of China’s renminbi had a noticeable effect on the USD’s share over time.

In part, the stability of USD in foreign exchange transactions comes from the outsized role it plays as a medium of exchange in global trade and payments. Federal Reserve (Fed) data shows that from 1999-2019, USD made up 96% of trade invoicing in the Americas and more than 70% for the rest of the world outside Europe, where the euro is the dominant currency.

The Fed’s reporting also shows that the USD is the dominant currency for international banking, with about 60% of international liabilities (mostly deposits) and claims (mostly loans) denominated in USD at the end of 2020, which changed very little from 20 years earlier.*

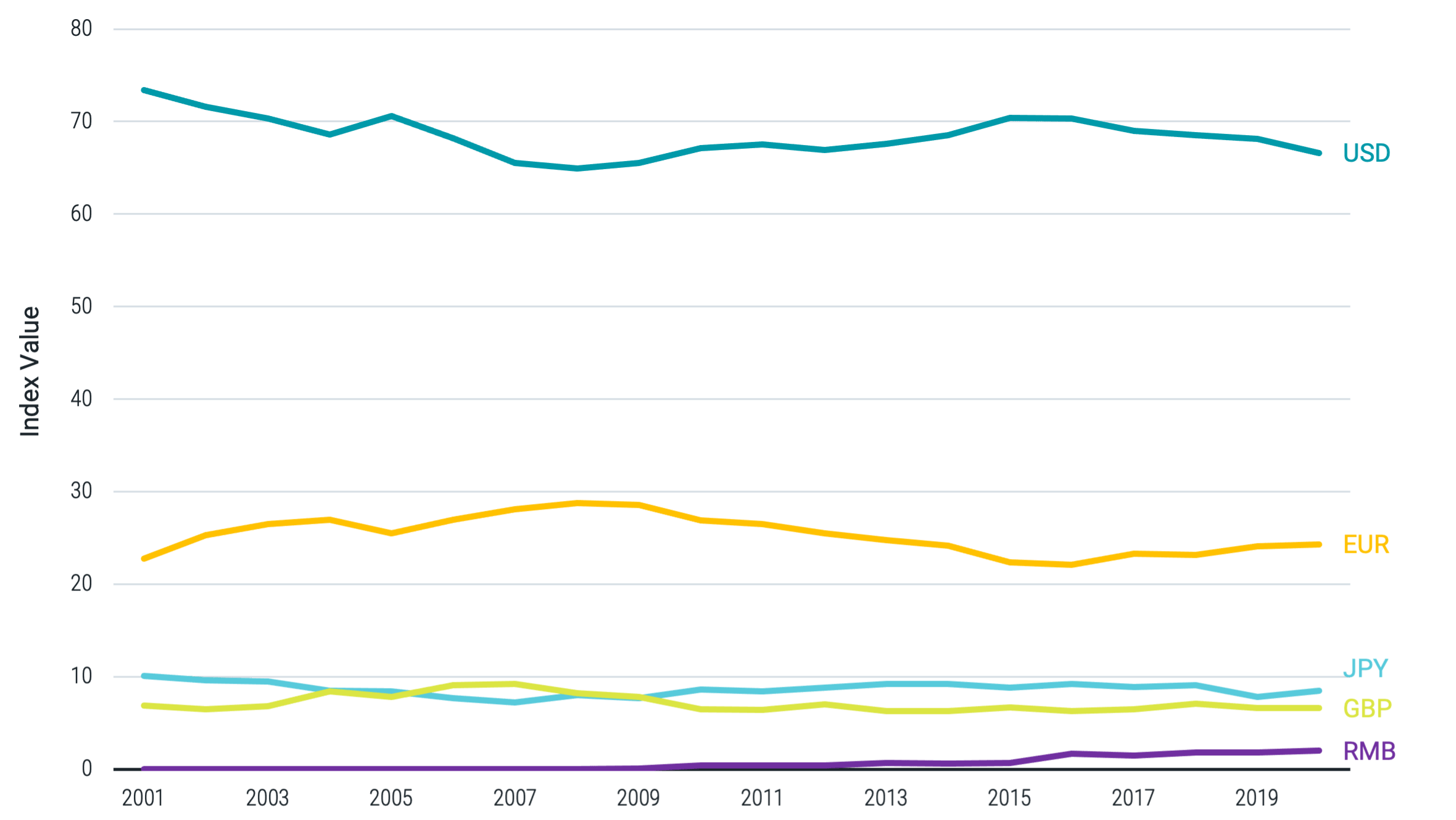

Given the many ways we can examine the usage of currencies, the Fed developed a useful index for summarizing various relevant indicators, including the share of foreign exchange reserves, the share of foreign exchange transactions, foreign currency debt issuance, and the share of international banking claims and liabilities.

Figure 4 shows the index results over the 20 years ending in 2020. The consistency of the USD’s usage over other currencies is quite clear. While the index doesn’t capture the last few years, data such as that in Figures 1 and 3, representing 50% of the index’s scoring methodology, offers no reason to expect a markedly different picture today.

Figure 4 | Federal Reserve Index of International Currency Usage

Data from 2001 – 2020. Source: Carol Bertaut, Bastian von Beschwitz, and Stephanie Curcuru, “The International Role of the U.S. Dollar,” FEDS Notes, Federal Reserve System Board of Governors, October 6, 2021. The index is a weighted average of each currency's share of globally disclosed FX reserves (25% weight), FX transaction volume (25%), foreign currency debt issuance (25%), foreign currency and international banking claims (12.5%), and foreign currency and international banking liabilities (12.5%).

The Wrap Up

From the data examined, we observe a slight decline in the USD’s share of global foreign exchange reserves over the last 20 years, but the dollar remains the world’s preferred reserve currency.

Further, we find that a decline in the share of reserves doesn’t necessarily mean that currency will depreciate —a potential consideration for investors. When we look at broader usage measures, there’s still no question that the USD continues to be the most heavily used currency in the world.

What the future holds remains to be seen, but today the dollar’s role in the global economy remains unrivaled.

Endnotes

* Carol Bertaut, Bastian von Beschwitz, and Stephanie Curcuru, “The International Role of the U.S. Dollar,” FEDS Notes, Federal Reserve System Board of Governors, October 6, 2021.

The opinions expressed are those of American Century Investments and are no guarantee of the future performance of any American Century Investments portfolio.

This material has been prepared for educational purposes only and is not intended as a personalized recommendation or fiduciary advice. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.