Trading Places: The Blip on the Radar That Can Cost Index Fund Investors

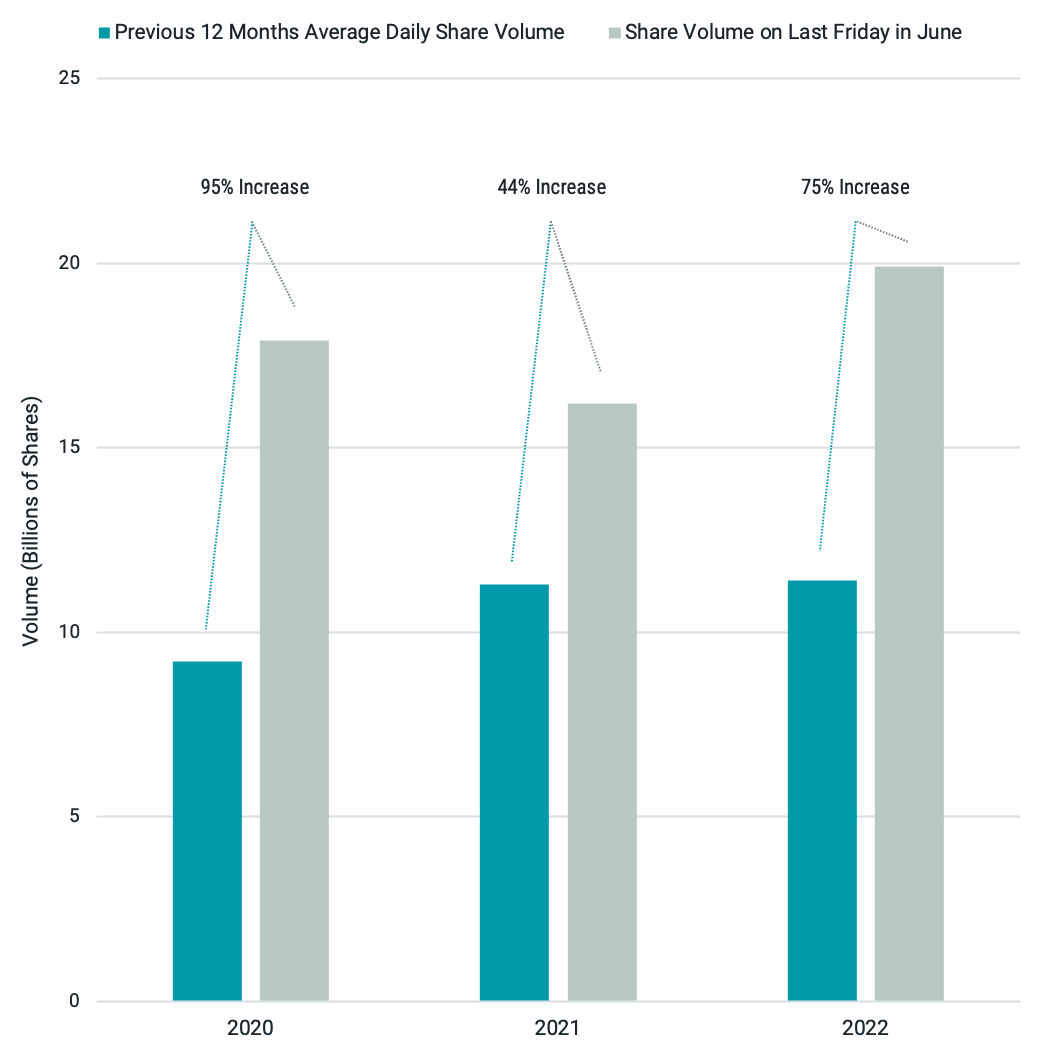

While investors continue to grapple with market turbulence, many may have missed that U.S. stocks recorded their highest trading volume of the past year on Friday, June 24. On this day alone, investors exchanged almost 20 billion shares, 75% higher than the average daily share volume of the last 12 months. See Figure 1.

Figure 1 | Volumes Traded on the Last Friday in June Are Much Higher Than Annual Averages

Sources: Bloomberg; New York Stock Exchange and Nasdaq Stock Market trades.

So, what led to this spike in trading volume? Each year, on the last Friday in June, FTSE Russell reconstitutes — or reclassifies — the holdings in its Russell U.S. indices. Russell places stocks into the various indices based on the underlying firm’s characteristics, such as its market capitalization or the multiple at which it trades relative to its book value or changes in its earnings.

When Russell reconstitutes its indices, funds and investors attempting to track those indices must place trades to:

Sell securities leaving each index.

Buy securities joining each index.

Buy/sell securities to adjust the old weights of securities staying in each index to their new weights.

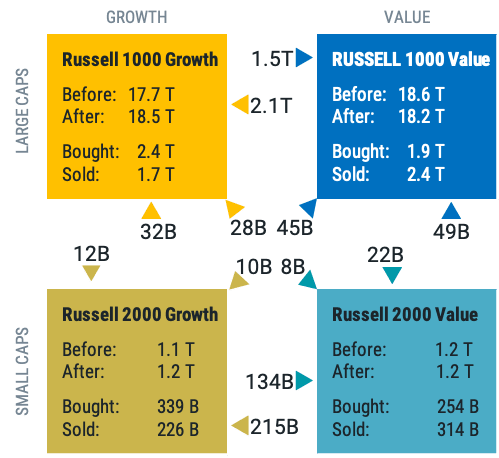

Figure 2 illustrates how the makeup of four well-known Russell indices changed during this last reconstitution.

Figure 2 | Changes in Russell Indices Due to Reconstitution on June 24

Data as of 6/24/2022. Source: Avantis Investors, Bloomberg. Figures are rounded.

The annual reconstitution triggers two primary questions:

Is there something special about the last Friday in June for classifying securities? No. If Russell reclassifies a stock, that only means the stock’s characteristics changed at some point over the last 12 months, requiring a move to a different index.

In many cases, a security’s characteristics may have changed much earlier — meaning they are more closely aligned to a different index — but Russell’s methodology keeps the stock in a particular index for the full year. In fact, one company that is moving from the Russell 2000 (a small-cap index) to the Russell 1000 (a large-cap index) returned -78% over the 12 months ending June 24, 2022. This means that while it has lost more than three-quarters of its market capitalization, it is still considered to be large enough to migrate from the small-cap to the large-cap index. However, it spent the last 12 months in the small-cap index because its significant price appreciation occurred after May 28, 2021 — the date Russell used to classify holdings for the 2021 rebalance

Does it really make sense to force all this trading into a single day? Russell’s reclassifications and the corresponding investor trades mean a large volume of shares — and a lot of money — trade hands in a short amount of time. Funds tracking these indices are competing for the shares of the underlying securities within a very short window, putting upward pressure on prices of securities they want to buy and downward pressure on prices of securities they want to sell.

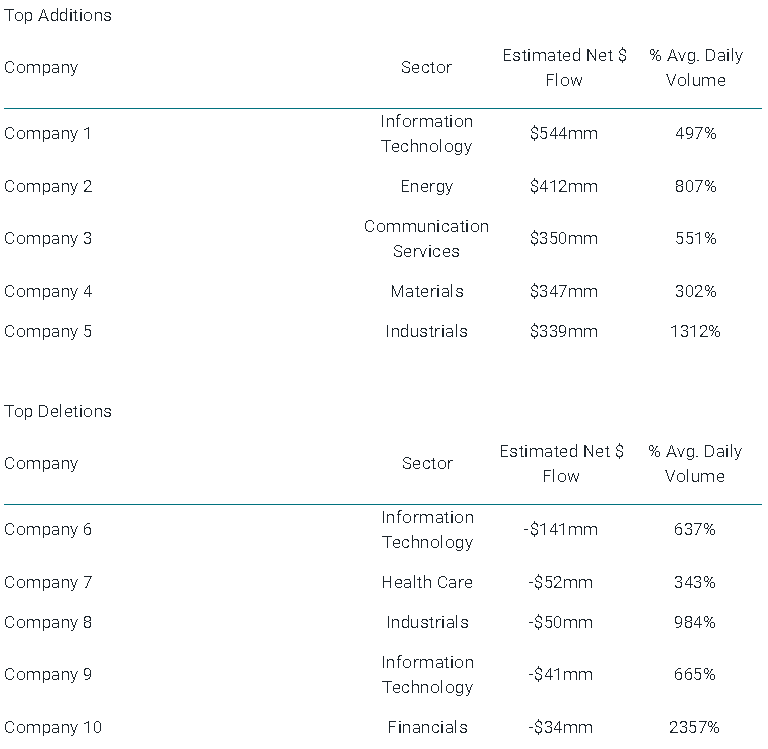

A look at the volume expected to be traded in individual securities added to the Russell indexes on the reconstitution date is striking and helps to illustrate why prices can be impacted by index rebalancing events.

In Figure 3, we show the estimated volume that needed to be traded for the five largest additions and deletions (by dollar volume) to the Russell 2000® Index. To highlight how this compares to previous trading days, we also show the estimated volume as a percentage of the prior 90-day average traded volume for each company. All were estimated to require at least 300% of their previous 90-day average volume.

Figure 3 | Too Much to Trade?

Estimated Percentage of Average Daily Volumes for Largest Adds and Deletes in Russell 2000 Index 2022 Reconstitution

Data as of 6/17/2022. Source: Jeffries.

Most would agree that attempting to trade multiples of a security’s typical volume should come at a cost. But how big is this cost? A recent study explored this question, finding securities added and removed from ETFs tracking public indices that pre-announce their trades and concentrate all turnover on a single or few days a year on average rose 67 basis points (adjusted for trade direction) in the five days leading up to the reconstitution date and fell 20 basis points over the 20 days that follow.1

These hidden potential costs are often unknown to investors of passive index funds, but their materiality can be meaningful. In some cases, these effects can be greater than the expense ratios of the index funds.

An alternative approach is to review updated stock information daily, comparing securities to others to determine which ones to buy, hold or sell. A process that allocates investor assets based on current (as opposed to stale) information is expected to add value over time. This doesn’t mean investors have to trade a lot each day, but only what’s necessary to keep the portfolio in the desired position. This method allows for a consistent focus on the desired asset class rather than making forced trades annually and all at once.

Glossary

Basis points (BPS): Basis points are used in financial literature to express values that are carried out to two decimal places (hundredths of a percentage point), particularly ratios, such as yields, fees, and returns. Basis points describe values that are typically on the right side of the decimal point--one basis point equals one one-hundredth of a percentage point (0.01%).

Russell 1000® Growth Index: Measures the performance of those Russell 1000 Index companies (the 1,000 largest publicly traded U.S. companies, based on total market capitalization) with higher price-to-book ratios and higher forecasted growth values.

Russell 2000® Growth Index: Measures the performance of those Russell 2000 Index companies (the 2,000 smallest of the 3,000 largest publicly traded U.S. companies, based on total market capitalization) with higher price-to-book ratios and higher forecasted growth values.

Russell 1000® Value Index: Measures the performance of those Russell 1000 Index companies (the 1,000 largest publicly traded U.S. companies, based on total market capitalization) with lower price-to-book ratios and lower forecasted growth values.

Russell 2000® Value Index: Measures the performance of those Russell 2000 Index companies (the 2,000 smallest of the 3,000 largest publicly traded U.S. companies, based on total market capitalization) with lower price-to-book ratios and lower forecasted growth values.

End Notes

1 Sida Li, “Should Passive Investors Actively Manage Their Trades?” (November 18, 2021). Available at SSRN.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Diversification does not assure a profit nor does it protect against loss of principal.

It is not possible to invest directly in an index.