A Penny Saved Is a Dollar Earned: The Advantages of Low-Cost, Modern Investment Solutions

Assets invested in the market over longer periods of time have the potential to increase significantly due to compounding growth. Fees also play a considerable role in this equation. A few basis points can seem like a marginal difference year over year, but when compounded over a longer horizon the savings can really add up. In this article, we look at the potential impact in both taxable and tax-deferred accounts.

Tax-Deferred Accounts

Tax-deferred accounts can be an efficient place to help achieve efficient growth in an investor’s portfolio. Assets have the potential to grow tax free without being affected by distributions. Due to the restrictions on annual contribution amounts, tax-deferred accounts can only accommodate a limited amount of assets, making effective use of this limited capacity even more important.

The consequences of paying excessive fees or sacrificing returns are magnified by the tax-sheltering benefits these accounts provide. Even very small differences—on the order of single-digit basis points (bps) in expense ratios or higher realized returns—can amount to considerably large differences in assets over longer periods.

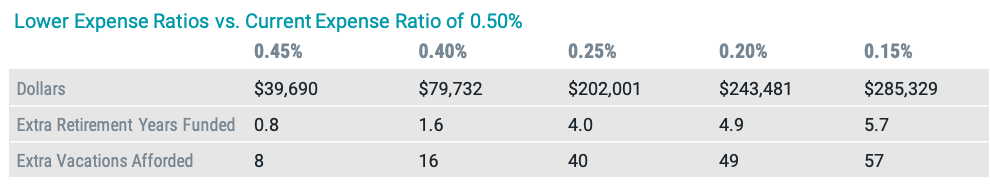

Table 1 shows a hypothetical example of the savings in tax-deferred accounts over a 20-year period for funds with expense ratios between 15-45 bps, relative to a baseline portfolio’s annual return of 8% and expense ratio of 50 bps. Reducing the expense ratio from 50 to 25 bps would allow extra earnings of more than $200,000 thanks to the tax-free compounded benefits these accounts provide. Assuming average yearly income of $50,000 in retirement, this savings is equivalent to an extra four years of income or a free $5,000 vacation every year for 40 years.

Even fee reductions of 5 bps can have substantial impacts on a portfolio. For example, reducing fees from 20 to 15 bps would amount to $42,000 in savings over 20 years. That’s nearly an extra year of retirement income or eight free vacations.

TABLE 1 | EXPENSE RATIOS SIGNIFICANTLY IMPACT SAVINGS IN TAX-DEFERRED ACCOUNTS

Source: Avantis Investors. We computedsavings on a post-tax pre-liquidation basis relative to a baseline portfolio of $1,000,000 with 8% annual returns and an expense ratio of 0.50% (50 bps). Assumptions include annual retirement income of $50,000 and vacation costs of $5,000 each. This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities.

Taxable Accounts

Given the contribution limits for tax-deferred accounts, many investors also leverage taxable accounts to help save for retirement. Income and capital gains taxes on distributions make asset growth in taxable accounts more expensive, particularly because these distributions tend to come during the working years, when investors are subject to higher tax brackets.

The use of exchange-traded funds (ETFs) in modern portfolios has the potential to enhance the benefits of taxable accounts. Since their creation in the early 1990s, ETFs have provided a more tax- efficient way of growing assets in a taxable account. While ETFs can also present benefits in tax-deferred accounts, there are additional benefits relative to mutual funds in taxable accounts, which shouldn’t be surprising given that mutual fund technology is more than 80 years old.

ETFs’ in-kind redemption mechanism can help taxable accounts get closer to achieving the tax benefits in tax-deferred accounts by minimizing or eliminating capital gains distributions. Placing ETFs in taxable accounts represents the next best option relative to tax-deferred accounts when constructing tax-efficient portfolios. While dividend income distributions are taxable, an ETF can maximize the percentage of Qualified Dividend Income (QDI) by excluding real estate investment trusts (REITs), master limited partnerships (MLPs) or other pass through securities and thoughtfully structuring their securities lending program, which can potentially increase the tax-efficiency of investments in the taxable account. We believe these factors, along with low fees and maintaining a diversified focus on higher expected returns, can contribute to asset growth over time.*

Also unique to ETFs, advisors may have the ability to put shares of the ETF out on loan through select custodians allowing their clients to benefit from rebates earned through the lending process.

As new financial innovations like ETFs mature into robust and cost-efficient vehicles, asset managers, advisors and investors are increasingly embracing this structure. Over the last five years alone, mutual funds have seen more than $650 billion in outflows, while ETFs have gathered more than $1.5 trillion of inflows. (Source: “US Exchange-Traded Funds,” 2020 Investment Company Fact Book.)

Factoring in Switching Costs

While ETFs can be a beneficial investment vehicle for taxable accounts in theory, advisors looking to modernize their clients’ portfolios by making the switch from mutual funds to ETFs should consider the costs associated with making the change and weigh them against the expected future benefits. Switching costs are typically driven by things like ticket charges for selling a mutual fund, applicable trading costs for buying ETFs and any taxes associated with selling out of a position in the portfolio currently at a gain.

Consider the example of switching into an ETF when the current price of the fund is flat relative to its cost basis, meaning tax costs are negligible. If we assume an average ticket charge of 1 bp on a $1,000,000 trade and average ETF trading costs of 14 bps (the half-spread of an ETF, a common measure of trading cost), that’s a switching cost of roughly 15 bps.

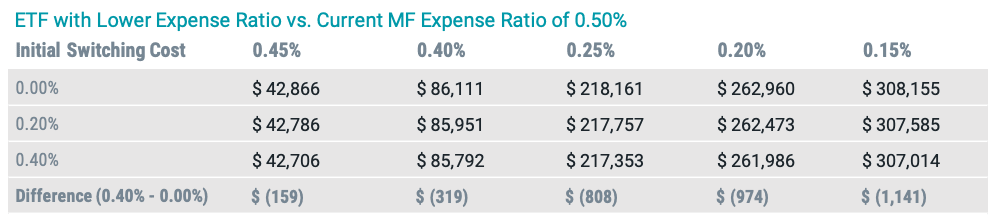

How do these one-time switching costs compare to the potential long-term savings? Table 2 provides a hypothetical range of cumulative savings over a 20-year period for the scenario outlined, grouped by the fee of the ETF and cost of switching. Continuing with the example of a switch from a mutual fund with an expense ratio of 50-bps to an ETF with an expense ratio of 25-bps, the savings would be $218,161 if we assume no switching cost. If we increase assumed switching costs to 20 bps, the savings decrease only slightly by $404 to $217,757.

Even in the extreme case where switching costs are 40 bps, the resulting difference in savings over 20 years’ time would be only $808. This is an inconsequential amount relative to the $217,353 the investor would have saved in fees over that period. In other words, under reasonable assumptions of spreads, ticket charges and taxes, our data suggests the upfront costs of switching to an ETF with a lower expense ratio pale in comparison to the long-term benefits. In fact, the cost of delaying such a move suddenly appear more relevant.

TABLE 2 | DIFFERENCES IN FEES AND TAXES SIGNIFICANTLY IMPACT EXPECTED OUTCOMES

Source: Avantis Investors. Shown for illustrative purposes only. This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities.

ENDNOTES

*Expected Returns: Valuation theory shows that the expected return of a stock is a function of its current price, its book equity (assets minus liabilities) and expected future profits, and that the expected return of a bond is a function of its current yield and its expected capital appreciation (depreciation). We use information in current market prices and company financials to identify differences in expected returns among securities, seeking to overweight securities with higher expected returns based on this current market information. Actual returns may be different than expected returns, and there is no guarantee that the strategy will be successful.

Exchange Traded Funds (ETFs) are bought and sold through exchange trading at market price (not NAV), and are not individually redeemed from the fund. Shares may trade at a premium or discount to their NAV in the secondary market. Brokerage commissions will reduce returns.

Mutual fund investing involves market risk. Investment return and fund share value will fluctuate. It is possible to lose money by investing in mutual funds.

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.

This information does not represent a recommendation to buy, sell or hold a security. The trading techniques offered do not guarantee best execution or pricing.

The contents of this Avantis Investors presentation are protected by applicable copyright and trademark laws. No permission is granted to copy, redistribute, modify, post or frame any text, graphics, images, trademarks, designs or logos.

FOR FINANCIAL PROFESSIONAL USE ONLY/NOT FOR DISTRIBUTION TO THE PUBLIC

©2025 American Century Proprietary Holdings, Inc. All rights reserved.