New Lessons for Predicting Future Expenses

With more and more consumers returning to “normal” life, spending habits have followed suit. Combined debit and credit card spending at the end of 2021, in fact, was not only back on track but 27% higher than that same period in 2019.1 Even though continued inflation may dampen some of these patterns, the point remains: People are spending money again.

But just as it’s been difficult to get back into making small talk at social gatherings (that can’t be just me!), it may be hard to figure out what our normal spending patterns will look like these days. However, whereas social rustiness probably isn’t that costly, an inability to accurately predict our expenses can be deeply so.

For instance, unexpected expenses commonly lead consumers to prematurely pull money from their 401(k)s, a practice that racks up roughly $7 billion in penalty fees.2 Similarly, many American consumers think—perhaps idealistically—that they’ll be able to pay off their credit card balance next month, and yet, they hold around $850 billion in credit card debt (and must pay the interest fees associated with that debt).3

So, having a better handle on our expenses—or rather, on the prediction of our expenses— could be enormously useful. It’s the thrust of dozens of personal finance apps that focus on better budgeting habits for everyday consumers. And, it’s a topic I discussed a few years ago in a post here. It’s time for an update, though, as a new paper by researchers Chuck Howard, Dave Hardisty, Abby Sussman and Marcel Lukas reports a novel way of addressing our expense prediction woes.4

But before I discuss that solution, let’s talk about how consumers go about making expense predictions in the first place. Try it along with me: Consider how much money you think you’ll spend next week. And now, how much do you think you’ll spend next month?

I’m normally not one to do party tricks, but I’m going try one out here. My guess is that in making your prediction, you first said something like, “Hmm, well let’s think about what I typically spend in a week.” (The beauty of this one-sided conversation is that I can go on pretending that I was right without being confronted with evidence to the contrary.)

You probably thought about the categories of typical expenses—groceries, maybe a meal out, some coffee purchases here or there—as well as how much you typically spend on those items. For your monthly budget, I bet you did something similar, and considered items like your rent or mortgage, your car payment, and so on.

If this is the process you went through, it would certainly make sense. It’s a lot easier to call to mind past expenses than it is to conjure up future, less well-known ones.

As Howard and his colleagues point out, however, there’s a problem with this type of strategy.

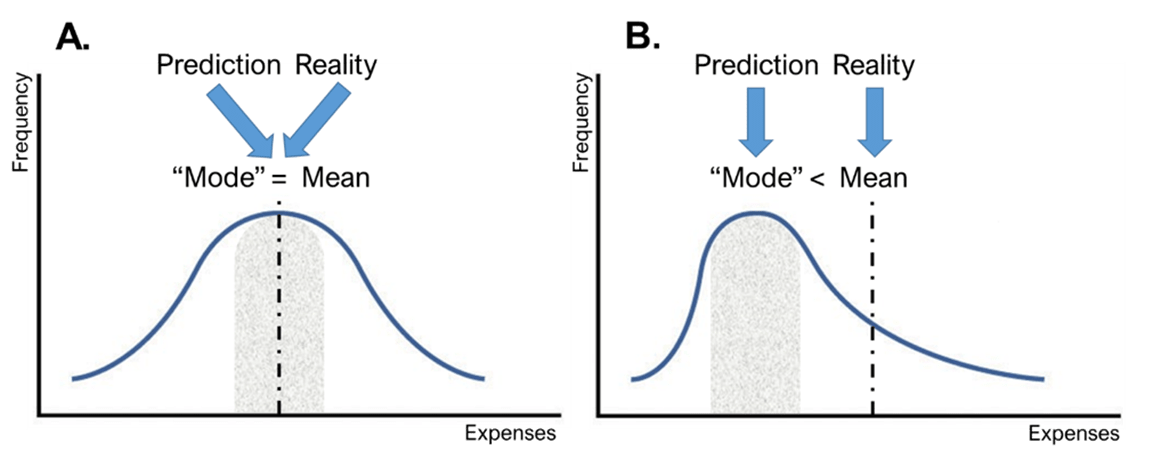

To explain, consider the figure below. In Panel A, you can see a “normal distribution” of expenses. What that means is that moderately sized expenses are the ones that occur most frequently (that’s the hump in the middle). And really low and really high expenses occur relatively infrequently (look at the tails on both ends of Panel A), but with equal likelihood.

You’d be just as likely, in other words, to have an atypical expense that was high (e.g., new tires) one week, as you would be to have an atypical expense that was low another week (e.g., printer paper). In this scenario, if you were to base your predictions about your future expenses on typical past expenses, you’d be pretty accurate because the mode—that is, the most frequently occurring expenses—matches up to the mean of the distribution.

But—and there’s always a but—look at Panel B. Here, you can see a “skewed” distribution. In this one, high expenses that are atypical (new tires, a surprise visit to the vet, a call to the plumber) occur with a higher likelihood than low expenses that are atypical. Put differently, in this scenario, when you have an expense that’s atypical, it’s more likely to be high than it is to be low.

And here’s the problem. If you use your typical expenses to make a prediction about future expenses, you’ll end up underpredicting your expenses. Why? Because the average of your typical expenses will be lower than the average of your typical expenses plus your atypical expenses.

Predictions When Expenses Are Normally Distributed (Panel A) vs. When They Are Skewed (Panel B)

Used with permission from Howard, et al., 2022.

In several studies with consumers from the U.S., Canada and the U.K., Howard and his colleagues found robust evidence for predictions that looked more like the “mode” in Panel B, but outcomes that closely resembled the skewed distribution. In other words, consumers regularly predicted expenses that ended up being lower than what they ended up spending.

But, if one reason that consumers often fail to make accurate expense predictions is that they neglect atypical expenses, then asking them to think of expenses that are different than usual should increase expense prediction accuracy.

It’s a strategy that seems to be effective. In one study, for instance, Howard and his co-authors partnered with a personal finance app and asked one group of consumers to think of a reason why next week’s online shopping expenses would be different from a typical week. Another group, however, was simply asked to make predictions about next week’s online shopping expenses. The group who thought about atypical expenses made predictions that were about 40% higher than those who didn’t. As a result, they were quite accurate in their predictions, with predictions roughly 2% off from actual expenses.

This intervention seems like an easy enough one to implement. The next time you are trying to determine what your spending patterns will be before you find yourself saying “Well, what were they in the past?” ask yourself instead, “What could be different moving forward?” It's important to note that in the research I’ve just covered, this trick of considering atypical expenses never changed how much people actually spent; rather, it changed their predictions of what they’d spend. In theory, with better planning comes better behavior. And, more accurate predictions, if sustained over time, should leave people better off.

I asked Abby Sussman, a co-author of the paper, if working on this project changed anything about her own budgeting habits. “Sure,” she told me, “I typically assume everything will be 20% more than I anticipate.” Now, that’s a “typical” assumption that might just work.

1 Elizabeth Dilts Marshall, “Big U.S. banks say spending patterns show consumers are in good shape,” Reuters, January 20, 2022.

2 Matt Fellowes and Katy Willemin, “The Retirement Breach in Defined Contribution Plans: Size, Causes, and Solutions,” Hello Wallet, January 2013.

3 Sha Yang, Livia Markoczy, and Min Qi, “Unrealistic Optimism in Consumer Credit Card Adoption,” Journal of Economic Psychology 28, no.2 (April 2007): 170-185; Federal Reserve Bank of New York, Center for Microeconomic Data, Quarterly Report on Household Debt and Credit, Q4 2021.

4 R. C. “Chuck” Howard, David J. Hardisty, Abigail B. Sussman, and Marcel F. Lukas, “Understanding and Neutralizing the Expense Prediction Bias: The Role of Accessibility, Typicality, and Skewness,” Journal of Marketing Research 59, no. 2 (April 2022): 435-452.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.