Helping Clients Deploy the Mental Tools of Wealth Accumulation in Their Decumulation Years

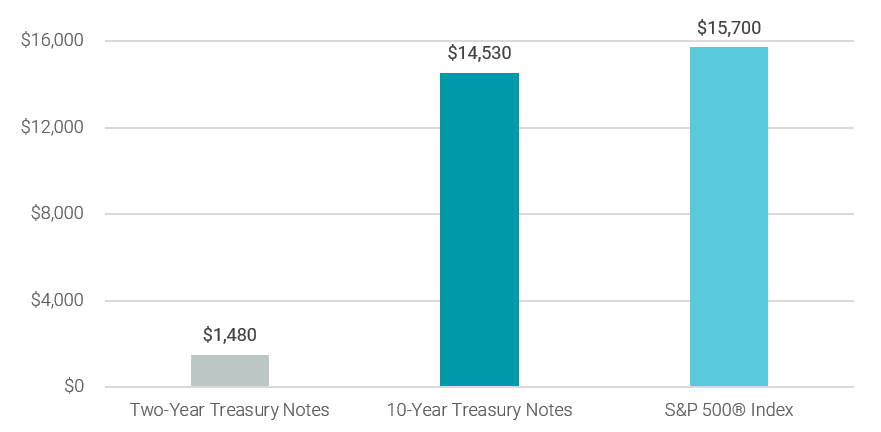

Portfolio income sustains us in retirement, but it’s hard to generate much income today because interest rates and dividend yields are so very low. As I write this in June 2021 and as illustrated in Figure 1, if we take current interest rates and yields and assume that we could have earned them consistently over the last 12 months, $1 million invested in two-year Treasury notes would have translated to an annual income of $1,480, $1 million in 10-year Treasury notes would have yielded $14,530 and $1 million in the S&P 500® Index would have yielded $15,700.

Figure 1 | What Income Would $1 Million Have Yielded Over a Year?

Data as of 6/8/2021. Source: Bloomberg. Past performance is no guarantee of future results. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities.

The mental tools of framing, mental accounting and self-control helped clients who saved substantial amounts in the accumulation phase of their lives. But these same mental tools often harm retirees by inhibiting prudent decumulations from substantial savings.

Financial advisers can assist two types of clients in the decumulation phase in two different ways:

Persuade them to abandon the mental tools that facilitated their wealth accumulation but may hinder appropriate decumulation. This involves making dips into capital transparent.

Convince them that the mental tools which helped them save to accumulate their wealth may also help them spend money wisely during decumulation. This involves keeping dips into capital opaque.

The Tools of Framing and Mental Accounting

We regularly frame our money into mental accounts, such as dividing our paychecks into pots. Sometimes these are tangible pots like checking accounts or glass jars. And sometimes they are virtual pots like Excel sheets or mental pots in our minds. We mark each pot with a label—rent, food, entertainment, or holiday gifts—and refrain from dipping into pots other than the ones designated for specific purposes. This practice makes budgeting easier and prevents bounced checks or disappointed gift recipients.

The pots of income and capital are especially important. The income pot includes salary, Social Security, pension, interest and dividends. The capital pot includes bonds and stocks, whether in tax-deferred accounts, such as a 401(k), or taxable accounts.

The Tools of Self-Control

During our accumulation years, we convert money from the income pot into the capital pot. We make contributions from our salary income into the capital of our tax-deferred and taxable accounts. And we make mortgage payments from our salary income into the capital of the equity in our homes.

The risk we face during accumulation years is dipping into capital—converting money from the capital pot into the income pot and spending it, leaving little for our decumulation years. We forestall such conversions by employing self-control rules, especially the rule of “spend income but don’t dip into capital.”

Decumulating Wisely

We face two dangers during our decumulation years. One is dipping into capital too fast, exhausting it before we exhaust our lives. The other is dipping into capital too slowly or not at all, living like misers despite possessing ample capital, and leaving behind much more money than we had planned.

Articles about decumulation tend to focus on the first danger, calculating conservative decumulation rates that help assure clients they won’t spend their last dollar before they die. Yet, advisers know well that many clients face the second danger. They decumulate too slowly for fear of spending their last dollar before taking their last breath or because they find it hard to stop saving and abandon the framing, mental-accounting and self-control rules of “spend income but don’t dip into capital.”

For example, one extremely wealthy man, a retired insurance company executive, said in response to a Wall Street Journal article I wrote on this subject: “I’ve struggled with boundary issues between income and capital. I’ve actually taken on a couple of board of director assignments so that I feel justified spending for what I consider extravagant.”1

Other clients don’t wish to break the habit of saving and refuse to abandon their self-control rules. For example, a reader of that same Wall Street Journal article said: “But what if the enjoyment is in saving, and the pain is in spending?” Another reader shared: “Every so often there are articles about people who have accumulated vast wealth relative to their lifetime income, and when they pass at an old age and people find out, they feel sad for them that they lived frugally and never spent it on anything. I sometimes think they are missing the point. The total enjoyment for that person was in the saving and living miserly and frugally and well below one’s means. To a certain degree, I am that person.”2

Advisers can address the fear of decumulating too fast by calculating conservative decumulation paths based on desires for bequests and exaggerated estimates of lifespans and medical expenses. But many clients will find that, even under these exaggerated estimates, they are likely to leave behind much more than they had planned.

Advisers can address reluctance to decumulate when clients prize their frugality. What kind of spending would bring them joy? If not spending on themselves, how about sharing their wealth with family, friends and the community? Isn’t it better to give with a warm hand than a cold one?

Opaque vs. Transparent Dips into Capital

Virtually all clients who insist on limiting their spending to income are, in fact, engaging in opaque dips into capital. One example is dips into capital by inflation, made opaque by “money illusion.”

Money illusion refers to the failure to distinguish “nominal” from “real” dollars, that is, dollars after inflation. For example, a 2% increase in a nominal annual salary, say from $100,000 to $102,000 is a 1% decrease in the real annual salary when the annual inflation rate is 3%.

We can see the distortions money illusion causes in the current concern about low bond yields. The average nominal yield on one-year Treasury bills during 2020, for example, was a meager 0.36%.3 The real yield was even lower, a negative 0.89%, because the rate of inflation during the period was 1.25%.4

Think of a client who received the nominal 0.36%, say $3,600 on an $1 million investment, considered it income and spent it. She dipped into capital by $12,500 because her $1 million in nominal terms is now worth only $987,500 in real terms when adjusted for the 1.25% inflation during the year.

We also see money illusion and opaque dips into capital in the absence of concern about low interest rates as in 1979, when the nominal yield on one-year Treasury bills was 9.73% and rate of inflation was 11.25%, implying a negative 1.52% real yield.5, 6 This results from the money illusion—comparing the low 0.36% nominal yield of 2020 to the high 9.73% nominal yield in 1979 while neglecting to note that the real yield in 2020, while negative, was higher than in 1979.

In truth, an investor with $1 million at the beginning of 1979 who considered the $97,300 (9.73% on $1 million) as income and spent it, dipped into capital by $112,500 because her $1 million in nominal terms is now worth only $887,500 in real terms when adjusted for the 11.25% inflation during the year.

Spending dividends is another example of opaque dips into capital. Imagine a client with $1 million in an S&P 500 Index mutual fund who receives $15,700 in dividends during the year, reflecting the current 1.57% dividend rate.7 Suppose the client considers that $15,700 dividend as income and spends it. She dipped $15,700 into capital, if inflation is zero, and more if inflation is higher than zero.

To illustrate the point, imagine money as analogous to apple trees. Capital is the apple tree, and income is the annual crop of apples the tree yields. The client and her family eat the apples in season, yet the tree—their capital—remains intact, ready to yield another crop next season.

Note, however, that by eating the apples the client and her family have dipped into capital. If they had sold the apples rather than eaten them, they would have been able to use the proceeds to buy apple tree seedlings, plant them and see their single apple tree grow into an apple orchard over time.

Analogously, if the client and her family spend their dividends, they’ll continue to have only one “money tree.” But if they reinvest their dividends, they’ll see their capital grow into a “money orchard.”

Helping Clients by Making Dips into Capital Transparent

One group of clients can be persuaded to understand that insistence on spending only income and refraining from dips into capital may lead to opaque dips into capital, whether by inflation or spending dividends. Moreover, some of these dips are costly and unwise.

For example, investors who aim to receive more income from their stock mutual funds than their annual dividend yields sometimes buy dividend capture funds. Managers of these funds buy stocks before companies pay quarterly dividends and sell them after collecting the dividends, in an effort to generate double the amount or more of annual dividends. Yet investors in these funds not only dip greatly into capital, but also harvest low returns because of high fees and extra taxes on dividends.

Helping clients understand they are actually dipping into capital opaquely when congratulating themselves on refraining from dips into capital may increase their willingness to adopt their advisors’ tailor-made spending plans. They may also become more amenable to the IRS’s conservative required minimum distribution (RMD) tables to guide prudent spending from tax-deferred and taxable accounts.

Consider a 75-year-old retiree with a $2 million portfolio divided equally between tax-deferred and taxable accounts. The RMD distribution period for that client is 22.9 years, implying a pretty optimistic 97.9 years of life expectancy. This means the RMD proportion distributed to this client is conservatively low, less than 4.4%. Depending on tax considerations, she could withdraw 4.4% from each tax-deferred and taxable account, or 8.8% from the tax-deferred account, or some combination of both. Of course, she could also withdraw more, if needed, or less, if feasible. Note, however, that these withdrawals would come from both income and capital.

This client could be a reader who responded to my Wall Street Journal article. “During my career I was a very conscientious saver and investor. I always maxed out my 401(k) contribution and put a large percentage of my salary and bonus into a deferred compensation program. I have had a difficult time changing my mindset from a saver to a spender. This article helped me make that mental transition. The first thing I did was to go out and get fitted for a new set of Ping golf clubs and I didn’t feel guilty about it!”

Helping Clients by Keeping Dips into Capital Opaque

The other group of clients can’t be persuaded to understand their insistence on spending income only likely leads to opaque dips into capital. Spending dividends and interest rather than reinvesting them are already opaque dips into capital. These dips, however, might be insufficient to maintain adequate retirement spending. Advisors can help these clients augment their retirement spending by keeping RMD dips into capital opaque. Clients ages 72 and older must withdraw money from tax-deferred accounts under RMD rules. These withdrawals are, in effect, dips into capital.

Many clients hasten to redeposit these withdrawals into saving accounts. Advisers might persuade them to regard these withdrawals as income, like Social Security benefits, and spend them. Indeed, clients can time these withdrawals monthly, to coincide with Social Security benefits.

Advisors Play Pivotal Roles in Helping Change Retirees’ Mindset

Transitioning from a saving mentality to a spending mentality isn’t easy, and some internal conflict is perfectly normal. But we save so that one day we may enjoy the fruits of our labors— the trip of a lifetime, sending a grandchild to college or supporting a cause we are passionate about. Advisers can not only help frame this transition but do so in a way that preserves clients’ sense of security and allows them to feel good about their spending.

DOWNLOAD THIS ARTICLE AS A PDF >

GLOSSARY

Consumer Price Index (CPI). CPI is the most commonly used statistic to measure inflation in the U.S. economy. Sometimes referred to as headline CPI, it reflects price changes from the consumer's perspective. It's a U.S. Bureau of Labor Statistics index derived from detailed consumer spending information. Changes in CPI measure price changes in a market basket of consumer goods and services such as gas, food, clothing, and cars. Core CPI excludes food and energy prices, which tend to be volatile.

Dividend. A payment of a company’s earnings to stockholders as a distribution of profits.

Dividend yield. The return earned by a stock investor, calculated by dividing the amount of annual dividends by net income for a given period.

S&P 500® Index. The S&P 500® Index is composed of 500 selected common stocks most of which are listed on the New York Stock Exchange. It is not an investment product available for purchase.

U.S. Treasury Securities. Debt securities issued by the U.S. Treasury and backed by the direct "full faith and credit" pledge of the U.S. government. Treasury securities include bills (maturing in one year or less), notes (maturing in two to 10 years) and bonds (maturing in more than 10 years).

Yield. Yield is a rate of rate of return on bonds and other fixed-income securities.

ENDNOTES

1 Meir Statman, “The Mental Mistakes We Make With Retirement Spending,” Wall Street Journal, April 24, 2017.

2 Statman, “The Mental Mistakes We Make With Retirement Spending.”

3 Annual FRED 1-Year Treasury Bill: Secondary Market Rate, Federal Reserve Bank of St. Louis.

4 Annual FRED Consumer Price Index for All Urban Customers: All Items in U.S. City Average, Federal Reserve Bank of St. Louis.

5 Annual FRED 1-Year Treasury Bill: Secondary Market Rate, Federal Reserve Bank of St. Louis.

6 Annual FRED Consumer Price Index for All Urban Customers: All Items in U.S. City Average, Federal Reserve Bank of St. Louis.

7 Bloomberg data as of June 8, 2021.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

The contents of this Avantis Investors® presentation are protected by applicable copyright and trade laws. No permission is granted to copy, redistribute, modify, post or frame any text, graphics, images, trademarks, designs or logos.