Managing Great (Inflationary) Expectations

Charles Dickens’ classic 19th century novel Great Expectations is a coming-of-age story about an orphan named Pip and the eccentric group of people who help shepherd him to adulthood. Featuring graphic imagery of poverty, prisons and fights to the death, the novel hits on themes of wealth and poverty, love and rejection, and good over evil. In this context, the word “expectations” means less about “hoping for something” and more about Pip’s windfall inheritance—his great expectation.

Many Americans have great expectations, too—not necessarily in terms of receiving an inheritance, but in saving enough for a comfortable retirement. Yet, approximately half of adults aren’t saving for retirement, according to a recent retirement preparedness survey.¹ Half of adults recognize that saving for retirement is essential, but 33% say it’s overwhelming and 26% consider it too complicated. Moreover, two in three adults don’t receive retirement saving advice from a financial professional. Of those not utilizing the services of a financial professional, over half say they would benefit from receiving advice (54%).

Inflation, the change in overall prices for goods and services, is one complicating aspect of saving for long-term goals. The most commonly used measure of U.S. inflation is the Consumer Price Index (CPI), which tracks a weighted average of prices of many consumer goods and services. In the 1930s, celebrated Yale University economist Irving Fisher argued that as the rate of inflation increases, nominal interest rates will tend to increase correspondingly.² The Fisher Effect holding true in the long run is an important reason why economists typically use real (inflation-adjusted) rates and dollar amounts in analyses. This is also why financial planners put all rates and amounts in inflation-adjusted terms—analyses of retirement adequacy, or calculations of how much capital households need at retirement, use inflation-adjusted rates of return on investments. In a low inflation period like what we have recently experienced, it’s not too hard to think about nominal dollars 10 years into the future. But it’s harder to get one’s mind around the nominal accumulations possible with financial investments over longer periods.

My favorite Finance 101 classroom example illustrates how a one-time investment of $1,000 in the Dow Jones Industrials Average on December 31, 1925, would have accumulated (assuming annual compounding, no reinvestment) to $6,526,580 as of December 2019 in nominal terms (averaging 7.4% per year), but only $482,315 in inflation-adjusted terms (with inflation averaging 2.78% per year). Inflation makes a big difference in consumer purchasing power over the long haul.

Most financial and retirement planning articles and textbooks say a client needs to make assumptions about the effects of inflation during the periods of asset accumulation and distribution in retirement.³ But, it isn’t reasonable to assume such expertise on the part of clients. A financial planner’s calculation methods might be confusing, so a little guidance on how to manage inflation expectations may help inform the conversation.

What’s a Reasonable Inflation Rate to Assume for the Future?

An instinct is to assume past trends will continue, but the COVID-19 pandemic may require us to rethink a simple extrapolation like that. Indeed, some say the Federal Reserve’s (Fed’s) recent recession-fighting monetary policy actions may lead to higher inflation.⁴

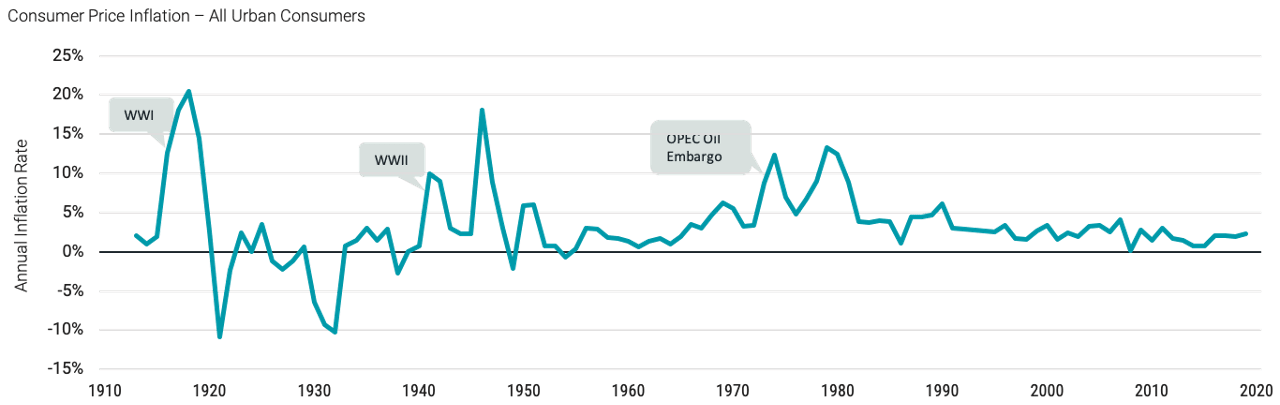

So, what’s the historical record of inflation? Over the period 1913-2019, the arithmetic average annual inflation rate was 3.21% per year, according to Federal Reserve Economic Data (FRED). Figure 1 illustrates how the annual CPI rate fluctuates from peaks and troughs of 20% and -11% around World War I to similar swings around World War II, from high sustained inflation rates during the 1970s’ OPEC oil price shocks to a steady low-inflation environment since the 2000s.

FIGURE 1 | ANNUAL INFLATION CAN FLUCTUATE SIGNIFICANTLY

Data from 1/1/1913-1/1/2020. Source: FRED, Federal Reserve Bank of St. Louis and U.S. Bureau of Labor Statistics.

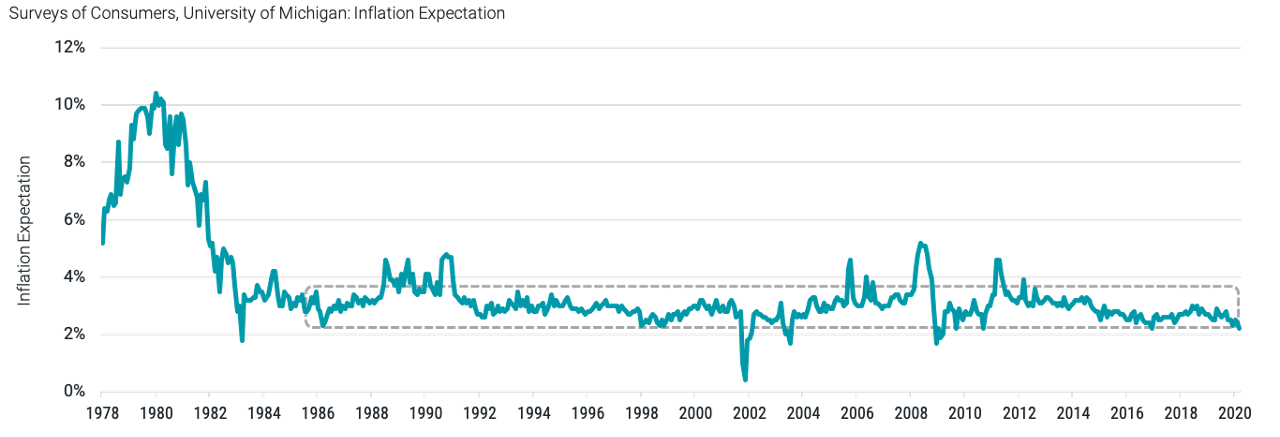

It’s tempting for future inflation expectations to be prominently influenced by the experiences of recent years. The University of Michigan’s Institute for Social Research publishes one of the most popular surveys of inflation expectations. Conducted monthly, the survey asks households to estimate expected price changes over the next 12 months. Figure 2 showcases inflation expectations on a monthly basis from 1978 onward. A steady level of inflation expectations since the mid-1980s has hovered around 3% with few spikes downward (2002) and upward (2008, 2011). There was a small downtick in the first three months of 2020 but nothing dramatic given the Fed’s large-scale asset purchase program intended to keep interest rates low and financial markets well-functioning to fight the COVID-19 recession.

FIGURE 2 | CONSUMERS' INFLATION EXPECTATION HAS HOVERED AROUND 3% SINCE THE MID-1980S

Data from 1/1/1978-3/1/2020. Source: FRED, Federal Reserve Bank of St Louis.

Viewing this data in relation to Figure 1 suggests these inflationary expectations track actual inflation quite well. A 2007 Journal of Monetary Economics study involving a forecasting experiment shows that survey forecasts outperformed several alternatives, including simple extrapolative time-series models and others using real activity measures like economic growth and unemployment.⁵ Determining that these survey forecasts do well on their own is probably the study’s most provocative finding. Making adjustments to account for biases from reporting lags or combining forecasts with other approaches yield worse or no better out-of-sample forecasting performance.

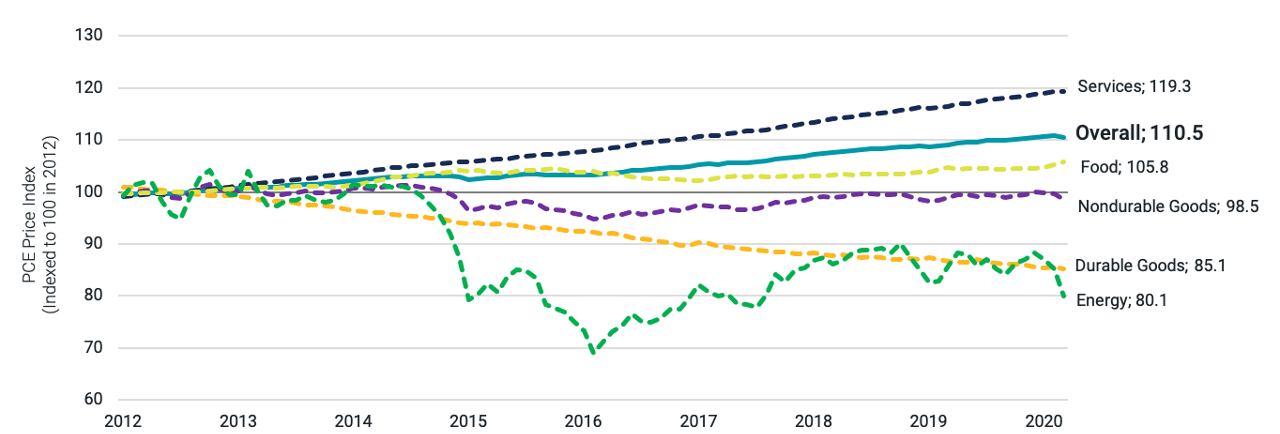

While inflation is a measure of the average change over time in the prices for a market basket of goods and services of a typical American, fluctuations in food and energy prices, which tend to be volatile, can heavily influence short-term changes. Core inflation typically excludes these two categories and is often the focus of policymakers when they gauge inflationary pressures. Core inflation includes consumer durables that are long-lasting items, such as cars and refrigerators, non-durable goods that households use more quickly, and services like health care, transportation, financial and recreation.

Figure 3 illustrates differences between inflationary pressures over the past eight years. Using December 2012 as the starting point, I compound the index of personal consumption expenditures (PCE) through March 2020 to represent 10.5% (teal line, final index level of 110.5). The more volatile, down-trending (green) line is the sub-index of PCE for energy only. It indicates negative inflationary, or deflationary, pressures of -19% over that same period, especially in the first three months of 2020 during the COVID-19 crisis. We can also see a steady deflationary trend in PCE durable goods only (orange line). It wouldn’t be surprising to think assumptions about future expected inflation incorporated into a customized financial planning exercise might be influenced by the more salient components of a consumer’s (aka investor’s) basket of purchases.

FIGURE 3 | UNDERNEATH THE OVERALL INDEX, CONSUMER PRICES CAN VARY GREATLY

Data from 1/1/2012-3/1/2020. Source: FRED, Federal Reserve Bank of St Louis.

Does the Fed Offer Useful Guidance?

Maybe experts at the Fed have a crystal ball that we could peak into? Indeed, the Fed explicitly states that an inflation rate of 2% per year is most consistent with its mandate for price stability and maximum employment over the long run. What we don’t know is which of the multiple measures of components of PCE that Fed officials study or what macroeconomic data they review to evaluate inflation trends. What we do know is that the Federal Open Market Committee (FOMC) releases transcripts and a statement to accompany its “projection materials” when meetings conclude. The Fed chair typically leads a press conference as well.

The statement for the December 10-11, 2019, meeting (issued December 11 at 2 p.m. EST) affirms that “on a 12-month basis, overall inflation and inflation for items other than food and energy are running below 2 percent."⁶ The projection materials, which survey Federal Reserve Board members and Federal Reserve Bank presidents, report a median core PCE inflation rate for 2020 of 1.9% with a (central tendency) range of 1.9% to 2.0%.

Before putting too much weight on this form of central bank forward guidance, know that scholars have also drilled down into such statements with the goal of extracting information to guide forecasts of future expected inflation and market returns.

A 2018 Quarterly Journal of Economics study, for example, looks at a high-frequency 30-minute window surrounding scheduled Fed announcements to gauge whether expectations about inflation move as a result of news about monetary policy.⁷

It turns out a tightening of monetary policy does reduce inflation, as theory and our intuition would predict, but the responses are remarkably small. This could imply that forward guidance is already known to market participants, making it a no “new” news event.

Should the Market’s Breakeven Expected Inflation Rates Be a Guide?

Could the markets themselves help manage our inflation expectations better? The U.S. Treasury bond and Treasury Inflation-Protected Securities (TIPS) markets are two of the largest and most actively traded fixed-income markets in the world. TIPS are like Treasury bonds except the principal amount is adjusted over time to reflect changes in consumer prices to protect the investor. A fixed coupon rate is applied to a principal amount that changes in response to realized inflation (or deflation), so the actual semi-annual coupon the investor receives in dollars changes similarly.

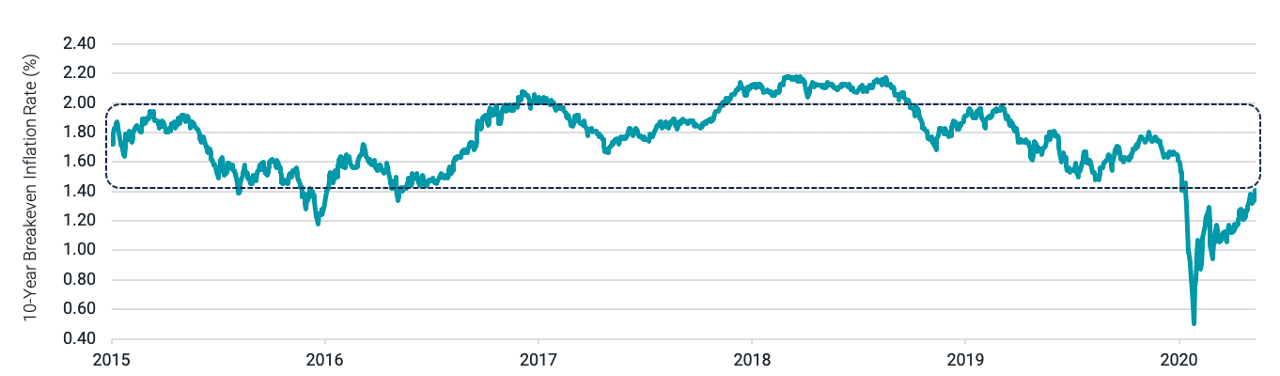

The difference between the nominal 10-year Treasury bond yield and the 10-year, inflation-adjusted TIPS yield implies the average rate bond market investors expect over the next 10 years. A 1% yield on a 10-year Treasury note associated with a 0.25% 10-year TIPS rate means an investor gets a so-called “breakeven inflation rate” of 0.75% per year over the next 10 years.

If that sounds low, examine Figure 4 which presents the daily 10-year breakeven inflation rate since 2015. It has hovered in the range of 1.40%-2.00% for much of that time. While there has been a spike downward during the COVID-19 crisis to a historically low 0.50% in early March 2020, it has trended upward since—approaching 1.40% at the end of June.

FIGURE 4 | THE BREAKEVEN INFLATION RATE HAS HOVERED BETWEEN 1.40% AND 2.00% FOR MUCH OF THE LAST FIVE YEARS

Data from 2/23/2015-5/22/2020. Source: FRED, Federal Reserve Bank of St Louis.

Some caution may be in order with these market-determined breakeven inflation rates. A 2014 Journal of Finance study shows that Treasury bonds are almost always assigned lower discount rates relative to TIPS—especially in times of increased market volatility.⁸

Such market dislocation means these two types of securities aren’t otherwise equivalent but for the inflation protection mechanism in TIPS, as assumed above. Most importantly, the Treasury-TIPS price differentials can’t be used to reliably back out the market’s inflation expectations with a high level of accuracy, as the breakeven rates are biased downward. Despite this known bias, this method could still be used to inform inflation expectations for financial planning purposes so long as we are cognizant of the inherent limitations, much like many other inputs in a long-term financial plan forecast.

Inflation Isn’t So Easy to Forecast

While the market’s implied forecasts for inflation aren’t reliable, there are few alternatives available to forecast it. Forward guidance from the Fed and other monetary policy authorities seems fraught. And extrapolating based on recent historical experience is likely more dangerous than ever in light of the COVID-19 recession and unprecedented Fed actions to counter its impact.

Maybe the best strategy for financial planning is to anchor the Fed’s inflation target and guidance with the 10-year breakeven rate from the market. The most important takeaway is that each investor should work closely with an advisor to build a diversified portfolio with an understanding that the actual path of inflation may be quite different than what was originally forecast. Monitoring and reassessing with an advisor help ensure nimble pivots in the allocation mix if the need arises.

GLOSSARY

Breakeven inflation rate. The breakeven inflation rate is the difference between the nominal yield (usually the market yield, which includes an inflation premium) on a fixed-income investment and the real yield (with no inflation premium) on an inflation-linked investment of similar maturity and credit quality. If inflation averages more than the breakeven rate, the inflation-linked investment will outperform the investment with the nominal yield. Conversely, if inflation averages below the breakeven rate, the investment with the nominal yield will outperform the inflation-linked investment.

Dow Jones Industrial Average. An average made up of 30 blue-chip stocks that trade daily on the New York Stock Exchange.

Federal Open Market Committee (FOMC). This committee sets interest rate and credit policies for the Federal Reserve System, the U.S. central bank. The committee decides whether to increase or decrease interest rates through open-market operations of buying or selling government securities. The committee normally meets about eight times per year.

Federal Reserve (Fed). The Fed is the U.S. central bank, responsible for monetary policies affecting the U.S. financial system and the economy.

U.S. Treasury securities. Debt securities issued by the U.S. Treasury and backed by the direct "full faith and credit" pledge of the U.S. government. Treasury securities include bills (maturing in one year or less), notes (maturing in two to 10 years) and bonds (maturing in more than 10 years). They are generally considered among the highest quality and most liquid securities in the world.

ENDNOTES

¹Morning Consult, “2019 Retirement Preparedness Survey,” Certified Financial Planner Board of Standards (CFP Board), https://www.cfp.net/knowledge/reports-and-statistics/consumer-surveys/2019-retirement-preparedness-survey

²Irving Fisher, The Theory of Interest as Determined by Impatience to Spend Income and Opportunity to Invest It (New York: The Macmillan Co., 1930).

³One popular example is Personal Finance by Jeff Madura (6th Edition, Pearson, 2017). See S.D. Hanna and K.T. Kim, “Treatment of Inflation in Retirement Planning Calculations: An Improved Method,” Journal of Financial Planning 30, no. 1 (2017): 44-53. Financial Planning Review features many relevant scholarly articles focused on financial planning. Co-edited by Dr. Vicki Bogan, my colleague at Cornell’s SC Johnson College of Business, the journal is disseminated to over 84,000 certified financial planners nationwide.

⁴Tim Congdon, chair of the Institute of International Monetary Research, recently penned a thoughtful editorial titled “Get Ready for the Return of Inflation.” (Wall Street Journal, April 23, 2020.) The piece evoked strong counterarguments such as “Inflation Isn’t a Big Risk, Even with All the Spending” from Desmond Lachman, a fellow at the American Enterprise Institute. (Wall Street Journal, April 28, 2020).

⁵Andrew Ang, Geert Bekaert, and Min Wei, “Do macro variables, asset markets, or surveys forecast inflation better?” Journal of Monetary Economics 54, no. 4 (May 2007): 1163-1212. Details on the Michigan Consumer Survey’s operations can be found at https://www.src.isr.umich.edu/services/survey-research-operations/

⁶Board of Governors of the Federal Reserve System, “Federal Reserve issues FOMC statement,” News release, (December 11, 2019). https://www.federalreserve.gov/newsevents/pressreleases/monetary20191211a.htm. “FOMC Projections Materials,” (December 11, 2019). https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20191211.htm

⁷Emi Nakamura and Jón Steinsson, “High-Frequency Identification of Monetary Non-Neutrality: The Information Effect, The Quarterly Journal of Economics 133(3) (2018): 1283-1330.

⁸Matthias Fleckenstein, Francis A. Longstaff, and Hanno Lustig, “The TIPS-Treasury Bond Puzzle,” Journal of Finance 69, no. 5 (October 2014): 2151-2197.

Mutual fund investing involves market risk. Investment return and fund share value will fluctuate. It is possible to lose money by investing in mutual funds.

Diversification does not assure a profit nor does it protect against loss of principal.

The opinions expressed are those of the portfolio team and are no guarantee of the future performance of any Avantis fund.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

This information does not represent a recommendation to buy, sell or hold a security. The trading techniques offered do not guarantee best execution or pricing.

The contents of this Avantis Investors presentation are protected by applicable copyright and trademark laws. No permission is granted to copy, redistribute, modify, post or frame any text, graphics, images, trademarks, designs or logos.