Investment Risk, Investor Risk Tolerance and Behavioral Goals-Based Portfolios

Key Takeaways

Investment risk is failing to reach an investor’s goals, not the volatility of portfolio returns.

Behavioral goals-based portfolios focus on achieving specific investor goals rather than minimizing risk.

Advisors should guide clients to better choices by understanding their goals and risk tolerance.

Consider your answer to the following question:

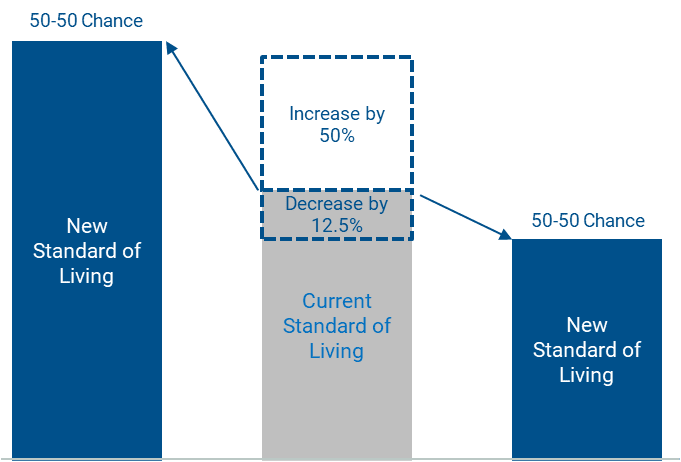

“Suppose you are given an opportunity to replace your current investment portfolio with a new portfolio. The new portfolio has a 50-50 chance to increase by 50% your standard of living during your lifetime. However, the new portfolio also has a 50-50 chance of decreasing your standard of living by X% during your lifetime. What is the maximum decrease you’re willing to accept in your standard of living?”

In a survey by Carrie Pan and me, people were willing to accept, on average, an approximate 12.5% decrease in their standards of living for a 50-50 chance at a 50% increase. See Figure 1. However, the range of responses was wide — from those unwilling to accept any reduction to those willing to accept a 50% reduction.¹

Figure 1 | Risk Tolerance Scenario

Source: Avantis Investors.

This question and its answers tell us a lot about investment risk, assessments of investor risk tolerance, investor goals and suitable behavioral goals-based portfolios. For one, investment risk is more precisely articulated as the failure to reach an investor’s goal, not the volatility of portfolio returns. An investor’s risk tolerance originates in her investment goals.

This question reflects two prominent goals. One is protection from poverty, such as having an adequate level of retirement income. The other is prospects for riches, such as the ability to travel worldwide, contribute to a child’s down payment on a house, or donate money to charities.

Risk in behavioral goals-based portfolios isn’t measured by the volatility of a portfolio's returns or even by portfolio losses but rather by the failure to reach goals. For example, investing an entire portfolio in a money market fund ensures low volatility. Still, it’s hardly a low-risk portfolio because it almost certainly guarantees it will fail to satisfy even a minimum retirement goal.

A financial adviser told me about a client who managed to save enough money to retire at 60. Her savings ethos derived from a poor childhood. She was always afraid she would end up living in a box eating cat food. Despite having more than enough money to sustain her lifestyle for the rest of her life, roughly 70% of her portfolio was in bonds. “By nature, I’m risk averse,” she said.

That woman speaks in the language of risk but thinks in the language of goals. Her goal of protection from poverty — not living in a box and eating cat food — motivates her to keep a fat protection-from-poverty portfolio layer in bonds.

Why does it matter if an investor speaks in the language of goals rather than the language of risk? Potentially, a lot. Persuading that woman in the language of risk not to be so risk averse is hard when she perceives risk aversion as part of her nature. It might be easier to persuade her in the language of goals and perhaps a spreadsheet that may satisfy her protection-from-poverty goal with a portfolio containing much less than 70% in bonds.

The Role of Advisors in Managing Behavioral Goals-Based Portfolios

Advisers who follow the behavioral goals-based approach don’t accept clients’ stated choices of percentage decreases in the standard of living for a 50-50 chance of a 50% increase, as is. They don’t proceed to construct portfolios and financial plans reflecting clients’ stated choices. Instead, they probe clients’ stated choices and guide them to better choices.

Does the very conservative offer of a 3% decrease in standard of living come from a man who is retired or close to retirement with financial capital in his protection-from-poverty portfolio layer but little or no human capital in current or potential employment income? Is the man satisfied with his current standard of living? Would he be able to draw on his financial capital to maintain his standard of living throughout his life with some margin to spare? If this is the case, then his 3% offer is reasonable and so is a portfolio heavy in cash and bonds.

Conversely, is the client a young man with little financial capital but substantial human capital in his protection-from-poverty portfolio layer, in a steady job and promising career? The adviser might point out to his client, perhaps with the aid of simulations, that his offer of a 3% reduction in the standard of living for a 50-50 chance for a 50% increase is likely to lead to a portfolio heavy in cash and bonds that wouldn’t support his current standard of living throughout his life, let alone increase it.

Advisers following the behavioral goals-based approach also ask questions that identify attitudes that interact with risk tolerance and possibly distort it. The survey revealed that investors who are highly confident in their ability to beat the market tend to declare high risk tolerance levels. Advisers should explore whether high declared risk tolerance reflects anything more than overconfidence.

Advisers do well when they listen to clients, ask them questions, empathize with their goals, and educate them. This includes educating them about risk and risk tolerance before prescribing suitable portfolios and financial plans intended to enhance their clients’ wealth and well-being.

Endnotes

1Carrie H. Pan and Meir Statman, “Questionnaires of Risk Tolerance, Regret, Overconfidence, and Other Investor Propensities,” Journal of Investment Consulting 13, No. 1 (2012): 54-63.

The opinions expressed are not necessarily those of Avantis Investors®. This information is for educational purposes only and is not intended as investment advice.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

The contents of this Avantis Investors presentation are protected by applicable copyright and trademark laws. No permission is granted to copy, redistribute, modify, post or frame any text, graphics, images, trademarks, designs or logos.