Fixed Index Annuities: A Compelling Tool to Help Improve Asset Allocations

Key Takeaways

After a sustained period of bond yields near historical lows, followed by rapidly rising short-term interest rates, advisors are navigating how to structure the “ballast” portions of their clients’ asset allocations.

The Fixed Index Annuity (FIA) structure can offer downside protection similar to a fixed-income allocation but diversify the return driver away from bond yields.

FIAs can complement some investors’ existing allocations, potentially improving expected returns while preserving desired rebalancing and liquidity characteristics of the overall asset allocation.

New FIA Option Offers Advisors a Way to Diversify the Driver of Returns Away From Bond Yields

Developing and maintaining sensible asset allocations is critical for advisors and financial planners as they guide clients along their respective investment journeys. The optimal allocation for each client’s portfolio should reflect a sense of achievable expected returns, consideration of potential risk drivers and an understanding of how the allocation may perform in various market environments.

Beyond that, you should be confident the allocation has been designed to deal with the uncertainties that will arise throughout the long investment journey. Your investment and client behavior expertise guide clients through the challenges of this ongoing process, making sure the assumptions are sound, targeting all possible cost and tax efficiencies, and choosing the most effective vehicle (e.g., ETFs, mutual funds, SMAs, FIAs) to deliver the strategy and managing behavioral biases.

Typical asset allocations consider equities as growth assets driving the compounded investment progress toward an investor’s goal together with fixed-income assets to help tame the risk of equities and make the portfolio “tolerable” for investors to stay the course during tough markets. Equities and fixed income working together have provided efficient asset allocations for generations. Most investors are willing to hold fixed income at its lower expected return profile relative to equities due to the risk management contributions it brings to the asset allocation.

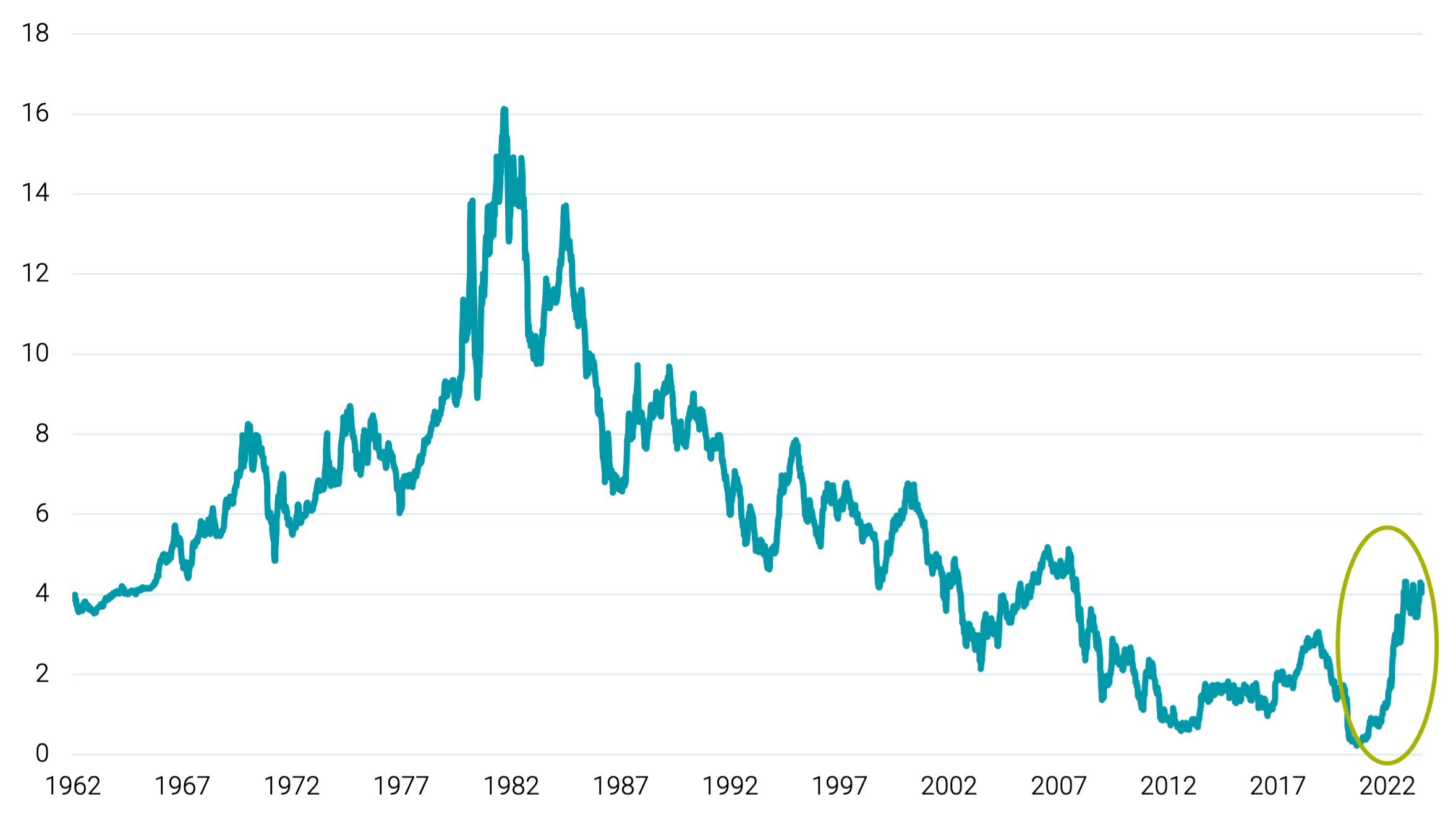

Figure 1 | After Historical Lows, Rates Have Increased Dramatically

5-Year U.S. Treasury Yield

Data from 1/2/1962 - 8/4/2023. Source: Federal Reserve Bank of St. Louis.

As illustrated in Figure 1, expected returns in fixed income have evolved significantly over the last several years. Bond yields, the main driver of expected returns in fixed income, have achieved both historical lows and rapid increases. Combined with significant recent inflation, this interest rate backdrop has raised questions about the optimal composition of the "risk hedging" portion of an asset allocation.

We can summarize the characteristics of a fixed-income allocation by its main desired feature, capital preservation. Bonds are fixed—income instruments that provide stability of principal with limited upside potential. And thanks to financial market innovations, a new instrument has similar characteristics—fixed index annuities, or FIAs.

A fixed index annuity provides stability of principal with limited upside potential, but the upside does not need to be driven by yields as it is in fixed income. FIAs present an opportunity for clients to diversify the drivers of expected growth away from yields. Getting a bond-like return with an independent driver of returns allows advisors to have one more tool to consider in an asset allocation—and in many cases, adding this new tool can help achieve better expected outcomes.

Given the benefits that fixed index annuities can bring to an asset allocation, Avantis Investors partnered with Barclays and DPL Financial Partners to design an index account for use within a commission-free fixed index annuity contract—specifically for advisors.

FIAs' bond-like behavior with a driver of returns based on equities independent from bond yields is expected to reduce the opportunity cost of the risk management component inside an asset allocation.1 This FIA is designed to fit seamlessly into an advisor's workflow for ease of managing the overall asset allocation, charging fees in their normal way and providing updated information to clients as needed. In this article, we provide a basic overview of the FIA structure, describe the index we designed alongside Barclays, and explain how this tool can complement an existing allocation mix of equities and fixed income.

Fixed Index Annuities vs. Fixed Income

A fixed index annuity is an instrument that promises the safety of the purchase payment amount plus any appreciation (in the form of interest credits) that can be linked, in part, to the performance of an underlying index. The contract owner commits to hold the instrument to maturity at which time they can take their money out, like purchasing a bond and holding to maturity.

Unlike a bond, the FIA is not taxed throughout its life but only when the owner withdraws taxable money, providing the benefit of tax deferral and enhancing accumulation potential.2 The contract maintains an account value throughout its life, allowing advisors to consider the FIA in their clients’ asset allocations.

Other features that make an FIA attractive for an asset allocation include the ability to adjust index account allocations, make withdrawals, and, in the case the contract owner dies, transfer the contract’s death benefit to a predesignated beneficiary.

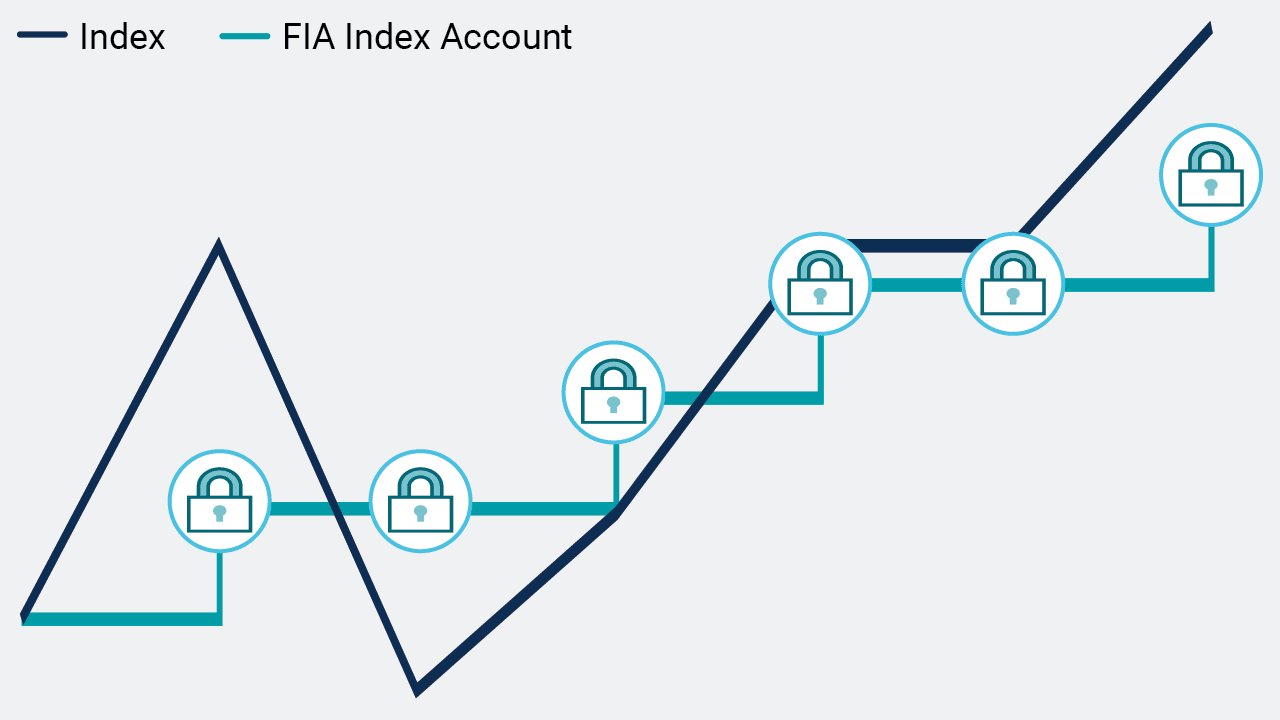

FIAs are designed with principal protection in mind, like a bond. One particularly interesting feature of the FIA is its annual “reset,” illustrated in Figure 2. The new contract value, set on each contract anniversary, is determined in part by any interest credits the contract receives. Protection applies to the previous year’s contract anniversary account value, with any interest credits applied to that amount on the following year’s anniversary value.

With this reset feature, the FIA contract offers benefits similar to rolling one-year bonds to maturity since the account value is updated annually, but without the current low expected returns associated with rolling one-year bonds.

Figure 2 | Annual “Reset” Mark Helps Preserve Principal

The annual high-water market feature of the FIA contract offers benefits similar to rolling short-term bonds to maturity.

Hypothetical illustration.

One frequent concern about FIAs (and annuities in general) relates to liquidity. While it is true that an FIA is not as liquid as a conventional fixed-income portfolio (many have surrender charge periods, although most commonly there is also a 10% annual free withdrawal provision), we believe the right mix between equities, fixed income and an FIA can sufficiently mitigate this issue.

Placing an FIA Inside an Asset Allocation

When building an asset allocation, advisors consider including risky assets for growth potential, e.g., equities (or stocks), and risk-management assets to tame the overall portfolio downside, e.g., fixed income (or bonds). The FIA can serve a purpose similar to bonds in an asset allocation but with some important distinctions:

Bond returns are driven by yield while FIA accumulation is powered by the index account(s) to which value is allocated.

Bonds provide liquidity but at a high opportunity cost given the current level of yields. FIAs provide less liquidity but, when used correctly, can help contribute to better expected outcomes.

Income from bonds is taxed annually while the FIA provides tax deferral until assets are withdrawn—a feature that could be particularly attractive for clients with time to accumulate savings.

Given these FIA and bond features, some clients—for example, those demanding continuous access to full liquidity—should choose bonds for their risk management allocations despite the high opportunity costs. Young clients may also choose bonds, given the low fixed income allocations they tend to have in their portfolios and the age limitations for withdrawing assets without penalty.

For clients with low liquidity demands, however, FIAs may be a good solution given the tax deferral benefits and higher potential for asset accumulation they can provide. Mixing an FIA and bonds could be an optimal solution for many consumers.

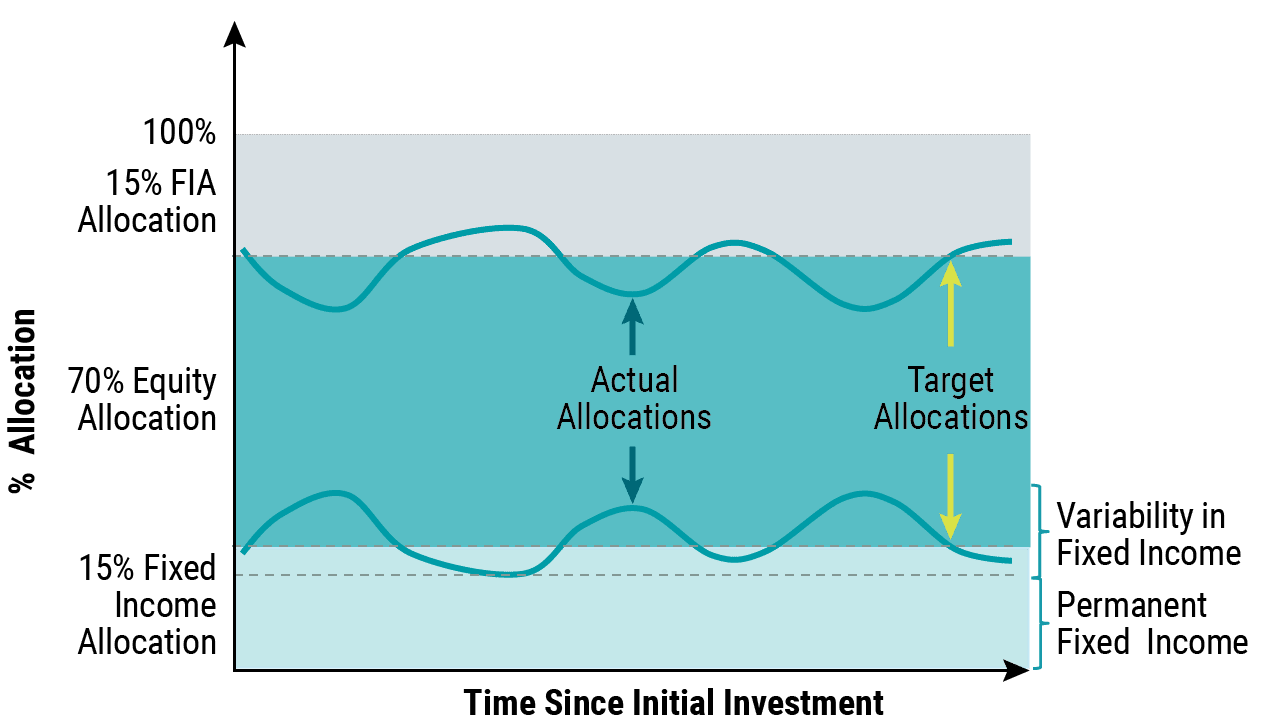

Imagine a consumer with an asset mix of 70% equities and 30% fixed income without high liquidity demands. The 30% allocation to fixed income provides the consumer with liquidity and stability of principal by taming the volatility of the overall allocation to their desired level, but at a high opportunity cost.

The liquidity that bonds provide allows the advisor to rebalance opportunistically when equities decrease in price, but this activity does not require the full 30% risk management allocation to be continuously liquid. Most risk management allocations have a permanent component of fixed income and a temporary component that increases or decreases depending on the relative performance between equities and fixed income.

This temporary component requires liquidity for rebalancing, so accepting an opportunity cost for this component seems reasonable. Facing an opportunity cost of holding bonds for the permanent component may not be the best option for the investor due to lower expected returns for liquidity that is not necessary. Accepting the opportunity cost of holding bonds for the permanent component affects the overall growth of the portfolio for no liquidity or volatility benefit.

An allocation with 70% equities, 15% fixed income and 15% FIA may be a better solution depending on the expected cash flow needs of the client. Figure 3 illustrates how this allocation could support opportunistic rebalancing between fixed income and equities while maintaining the allocation to an FIA.

Figure 3 | Adding an FIA While Keeping Enough Fixed Income to Facilitate Rebalancing

Our research indicates splitting the risk management assets between FIAs and fixed income can still allow for sufficient flexibility in rebalancing.

Hypothetical example for illustrative purposes only.

Building an Effective Index for an FIA

When thinking about an FIA it is important to understand the relevant operational features to create an efficient index. Avantis and Barclays joined forces to create the Avantis Barclays Volatility Control Index, which is designed to provide the FIA asset accumulation with features that allow for cost-effective hedging to help improve investor outcomes.3

The Avantis Barclays VC Index targets a 10% annual volatility level, a lower amount than equities, by mixing two-, five- and 10-year Treasuries with a portfolio of large-cap U.S. stocks. Managing the index to target 10% annual volatility, no matter the market environment allows for more cost-effective hedging, which we believe can improve expected outcomes for FIA owners by increasing potential participation rates.

In calm markets the Avantis Barclays VC Index has higher exposure to equities, while in tough markets the index increases its allocation to Treasuries to help manage risk and hedging costs more effectively.

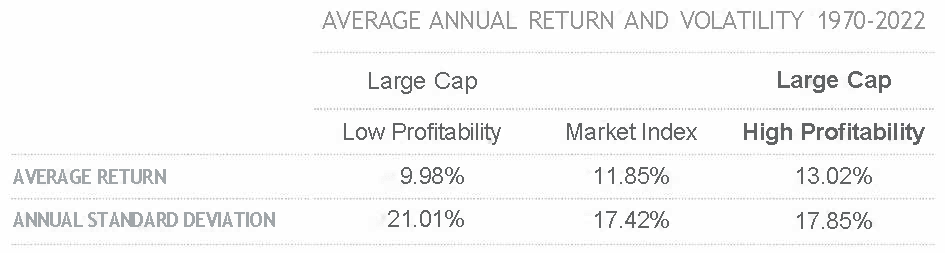

The equity component of the index focuses on a diversified set of approximately 300 U.S. large-cap stocks selected for their high profitability and reasonable price relative to their book values. Academic research, including work from Novy-Marx, Fama and French, and Wahal has shown that companies with higher profitability have historically outperformed those with lower profitability.4 See Figure 4.

The returns from just using profitability can also be enhanced by considering the relative price at which these companies are trading. This diversified portfolio of higher relative profitability securities is rebalanced annually to maintain its focus on expected returns. The equity component of the index is a total return strategy, including the capital appreciation of the stocks plus any dividend distributions.

Figure 4 | Considering Profitability and Valuation Can Improve Performance Potential Over a Market-Cap Weighted Index

Source: Kenneth R. French Data Library, Dartmouth College.

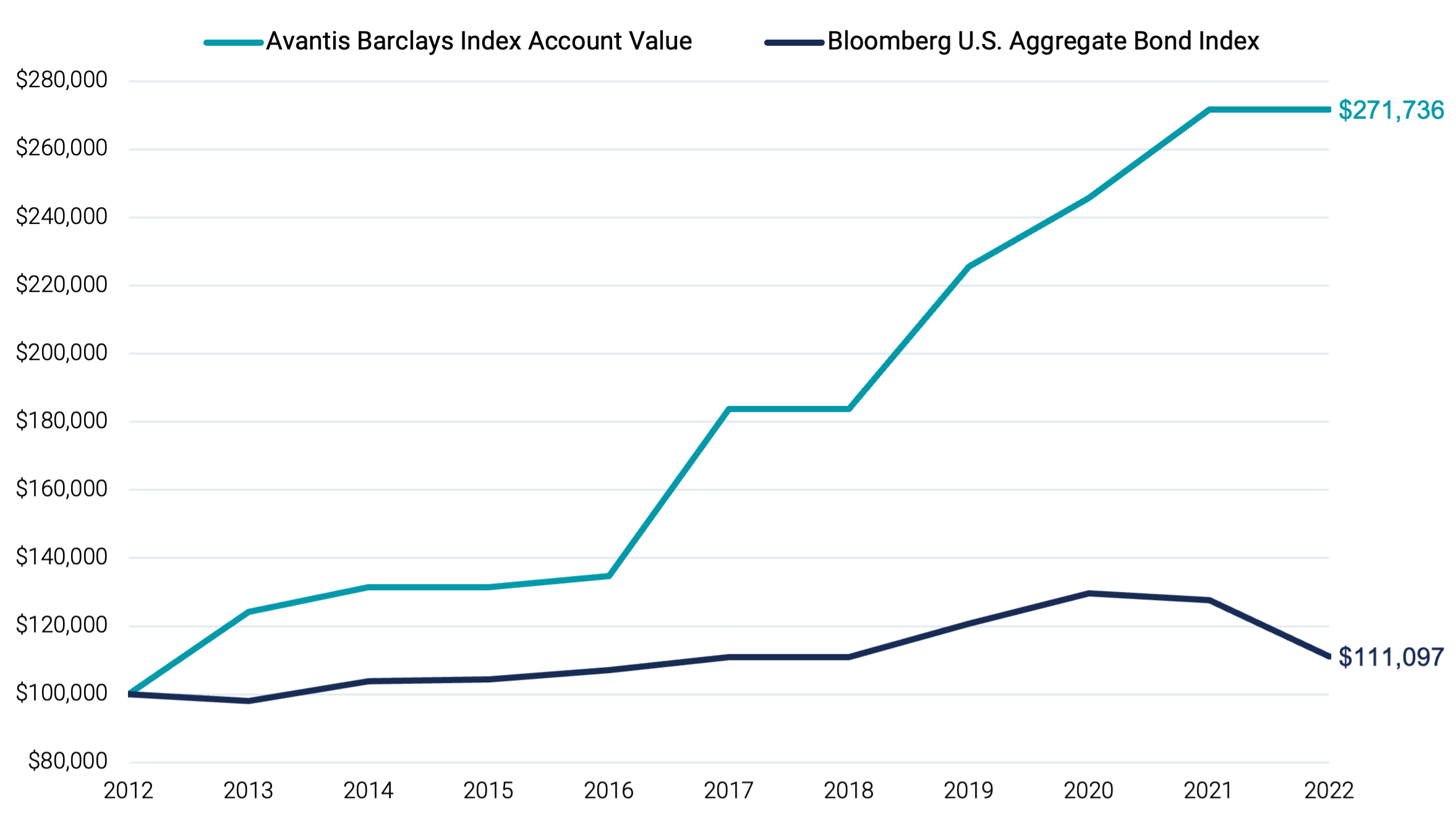

Figure 5 shows the simulated historical performance of the Avantis Barclays VC Index account inside a commission-free FIA versus the Bloomberg U.S. Aggregate Bond Index. Panel A shows the cumulative growth of $100,000 invested in an FIA whose participation rate (in this example, a 115% participation rate) is tied to the performance of the Avantis Barclays VC Index account and $100,000 invested in the Bloomberg U.S. Aggregate Bond Index over the last 10 years. A $100,000 investment in the Avantis Barclays VC Index account at the end of 2012 would have grown to $271,736 at the end of 2022, compared to just $111,097 for the Bloomberg U.S. Aggregate Bond Index over the same period.

Figure 5 Panel A | Hypothetical Growth of $100,000 Over the Last 10 Years

Data from 12/31/2012 - 12/31/2022. Source: Avantis Investors. Hypothetical results for illustrative purposes only. It is not possible to invest directly in an index.

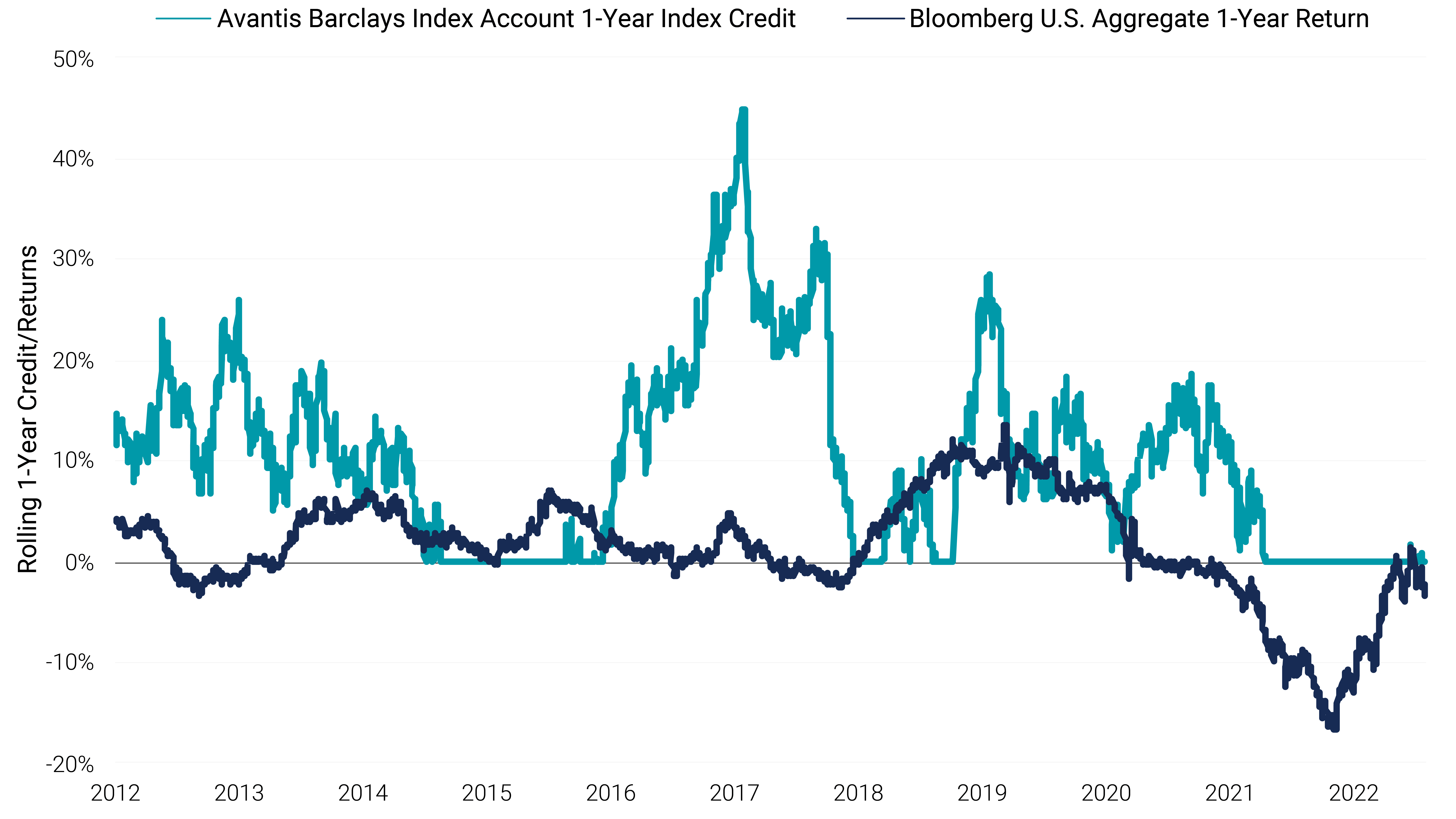

Panel B compares rolling one-year returns of the Avantis Barclays VC Index with an assumed 115% participation rate inside a seven-year, commission-free FIA alongside returns of the Bloomberg U.S. Aggregate Bond Index with an assumed purchase date of December 31, 2011.

Each line represents the rolling one-year return for the respective index over the last 10 years and demonstrates how, by incorporating an FIA into the risk management component of an asset allocation, consumers can achieve some diversification of return drivers and potentially reduce the opportunity cost associated with holding risk management assets. It is worth noting that even with fixed income there is a possibility of facing negative returns, while the FIA is designed to avoid that outcome, which we believe makes it an ideal option for risk mitigation.

In historical simulations using a fixed 115% participation rate and an uncapped index crediting design, the FIA account using the Avantis Barclays Volatility Control Index Account outperformed the Bloomberg U.S. Aggregate Bond Index with similar risk characteristics and better downside protection over the period 2012-2022.

Figure 5 Panel B | FIA Avantis Barclays VC Index Account vs. Bloomberg U.S. Aggregate Bond Index

Hypothetical Rolling 1-Year Results

Data from 12/31/2012 - 12/31/2022; assumes a 115% participation rate in the Avantis Index Account. Sources: Security Benefit, Avantis Investors, Barclays. Hypothetical results for illustrative purposes only. Past performance is no guarantee of future results.

Summary

At Avantis, we are committed to using financial science to help design investment solutions that can improve expected outcomes for investors. While financial innovations bring new instruments that can enhance an investor’s asset allocation, we also recognize there is a need to understand these instruments, including any potential drawbacks and constraints, when determining whether or how to best use them in a client’s asset allocation.

We believe fixed index annuities provide an innovative tool to help manage the risk profile of an asset allocation. They bring a diversified source of returns to bonds to help advisors achieve better asset allocations and potentially better performance for their clients.

The tax deferral that FIAs provide can also improve after-tax portfolio accumulation for investors. Commission-free fixed index annuities are also designed to fit into the advisor workflow, enabling RIAs to see their overall allocation to equities, fixed income and annuities, and charge fees appropriately.

1 Wade Pfau, “A Day at DPL with Wade Pfau | How a fixed index annuity works,” DPL Financial Partners, February 4, 2022; Roger G. Ibbotson, “Fixed Indexed Annuities: Consider the Alternative,” Zebra Capital Management, January 2018.

2 Withdrawals are subject to ordinary income tax and, if made before age 59½, subject to a 10% penalty tax.

3 For more information, visit THE AVANTIS BARCLAYS VC INDEX.

4 Robert Novy-Marx, “The Other Side of Value: The Gross Profitability Premium,” Journal of Financial Economics, 2013; Eugene Fama and Kenneth French, “A five-factor asset pricing model,” Journal of Financial Economics, 2015; and Sunil Wahal, “The profitability and investment premium: Pre-1963 evidence,” Journal of Financial Economics, 2019.

Expected Return: Our philosophy is based on the idea that paying less for an expected stream of cash flows or the equity of a company should produce higher expected returns. Our systematic, repeatable and cost-efficient process uniquely designed for Avantis Investors is actively implemented to deliver diversified portfolios expected to harness those higher expected returns.

This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities.

The Avantis Barclays Volatility Control Index (the “Index”) aims to provide exposure to profitable firms priced at good value and to U.S. Treasuries incorporating advances in financial research that have revolutionized how we think about investing over the last 50 years. To further control risk, the Index aims to limit its annual volatility to a 10% target using a procedure called volatility control. The Index focuses on U.S. large-cap stocks while considering additional known drivers of expected returns in its design. The Index seeks to overweight companies with strong profitability trading at attractive valuations while remaining broadly diversified across individual companies and sectors.

Source: Barclays. Any cumulative index performance and annualized index returns shown above are calculated using month-end data. Maximum drawdown and risk/return statistics for such period are calculated using daily data (except for certain indices which have no exposure except for certain days of the month, for which monthly data is used). Simulated period: Index Base Date is 31 Dec 2002, Index Live Date is 10 Nov 2021. Past and/or simulated past performance are not reliable indicators of future performance.

Diversification does not assure a profit, nor does it protect against loss of principal. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Neither Barclays Bank PLC (“BB PLC”) nor any of its affiliates (collectively, “Barclays”) is the issuer of the fixed index annuity (the “Product”) and Barclays has no responsibilities, obligations or duties to purchasers of the Product. The Avantis Barclays Volatility Control Index (the “Index”), including as applicable any component indices that form part of the Index, is a trademark owned by Barclays. Barclays’ only relationship with the Issuer in respect of the Index is the licensing of the Index, which is administered, compiled and published by BB PLC in its role as the index sponsor (the “Index Sponsor”) without regard to the Issuer or the Product or purchasers of the Product. The Product is not sponsored, endorsed, sold or promoted by Barclays and Barclays makes no representation regarding the suitability of the Product or use of the Index or any data included therein. Barclays shall not be liable in any way to the Issuer, purchasers or to other third parties in respect of the use or accuracy of the Index or any data included therein.

The Avantis U.S. Quality Large Cap Index and the proprietary data related thereto (the “Avantis Index”) are the property of American Century Investment Management, Inc. (“American Century”) and are used under license by Barclays Bank PLC. Neither American Century nor any of its affiliates makes any representation, warranty or assurance, express or implied regarding the Avantis Index, the advisability of purchasing securities generally or the Product particularly or the ability of the Avantis Index to track general market performance or provide positive investment returns.

Neither American Century nor its affiliates are under any obligation or liability in connection with the Product. Inclusion of a security within the Avantis Index is not a recommendation by American Century or its affiliates to buy, sell, or hold such security, nor is it considered to be investment advice. American Century does not guarantee the accuracy and/or the completeness of the Avantis Index and American Century is not and shall not be subject to any damages or liability, direct or indirect, consequential or punitive for any errors, omissions, or delays in or related to the Index.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

FOR FINANCIAL PROFESSIONAL USE ONLY