Does Market Timing Work?

One dollar invested in U.S. stocks at the end of 1900 would be worth $51,149 (annualized rate of return of 11.3%) at the end of 2018 while the same dollar invested in U.S. Treasury bills would be worth $58 (annualized rate of return of 3.5%).1 In contrast, an investor who had perfect foresight and correctly chose to reallocate the entire portfolio to either stocks or Treasury bills at the beginning of each year would have accumulated $22.3 million (annualized rate of return of 16.0%)!2 Given these hypothetical results, it’s not surprising that market timing has tremendous allure.

This subject is also important to investors who have recently seen record stock market highs. When the Dow Jones Industrial Average was hovering around 29,000 at the beginning of 2020, investors questioned whether market valuations reflected efforts to boost the economy or some type of irrational exuberance. Now, with the Dow trading much lower in the wake of the coronavirus pandemic, investors are asking whether the market is overreacting or whether we can expect it to go lower. Underlying all these discussions is the belief that one can somehow predict where the market is headed next and invest accordingly.

Shiller’s CAPE Ratio

Academic literature has proposed many predictors of market returns. One of the most widely used is 2013 Nobel Laureate Robert Shiller’s cyclically adjusted price-to-earnings ratio (CAPE). CAPE is the ratio of current price to a moving 10-year average of earnings. High CAPE indicates prices are high relative to past earnings. Shiller views a high reading as a sign the market is overvalued, and based on data covering 1900-2018, there is some evidence that high CAPE is followed by low market returns. Using this evidence, could one build a market-timing portfolio that gets close to the perfect foresight portfolio?

Market Timing Strategies vs. Buy and Hold

We could employ many types of market-timing strategies, but for simplicity in this paper, we will discuss two3:

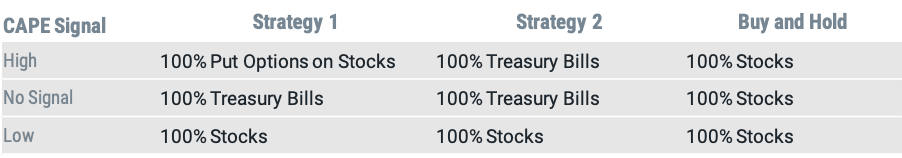

Strategy 1. When CAPE is low (indicating market underpricing), hold 100% of the portfolio in stocks. When CAPE is high (indicating market overpricing), invest 100% of the portfolio in put option contracts. In this case, a put option contract is a risky bet that the U.S. stock market will decline. In the absence of a clear signal, invest 100% of the portfolio in Treasury bills.

Strategy 2. When CAPE is low (indicating market underpricing), hold 100% of the portfolio in stocks. When CAPE is high (indicating market overpricing), invest in Treasury bills. In the absence of a clear signal, invest in Treasury bills.

The only difference between the two strategies is that the first is more aggressive due to the investment in put options based on an overvaluation signal. Given the negative correlation between CAPE and subsequent one-year returns, it’s tempting to think this strategy would be more profitable.

For this analysis, we’ll define “high” CAPE as being in the top 25% of historical results and “low” CAPE as the bottom 25%. We’ll treat anything in between as “no signal.” Figure 1 summarizes portfolio exposures in each market-timing scenario compared to a buy-and-hold strategy.

FIGURE 1: PORTFOLIO EXPOSURES IN MARKET-TIMING SCENARIOS

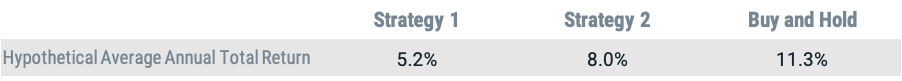

Examining hypothetical returns from 1900-2018 shows Strategy 1 underperformed Strategy 2 by 5.2% to 8.0%. Though Strategy 1 is more aggressive, it underperformed due to heavy losses when it incorrectly predicted a market decline and exacerbated the mistake with a put option contract. More importantly, both market-timing strategies trailed a buy-and-hold investors’ return of 11.3% over the same sample period, as shown in Figure 2. Market timing does not seem to work in practice.

FIGURE 2: RETURNS IN MARKET-TIMING SCENARIOS

Data from 1/1/1900-12/31/2018. Source: Center for Research in Security Prices.

Look-Ahead Bias

The preceding analysis suffers from a look-ahead bias. This is created by the fact that the definition of high or low CAPE was determined by comparing CAPE in a particular year to its distribution over the entire sample period. Real-time investors, obviously, do not have that luxury. Their determination of high or low CAPE is based only on what they have observed up to that date. For example, at the end of World War II in 1945, CAPE was at 17.8, which would have been high based on the data at that time. Therefore, a market-timing investor at the end of 1945 could have reasonably concluded the market was overvalued. In contrast, a fictitious investor who had access to data up to 2018 could have concluded the CAPE reading was “no signal.”

How would real-time investors have done in 1945? If they had followed the first (more aggressive) strategy, their returns would have been a miserable 1.2%. They would have fared better by employing the second (less aggressive) strategy, which delivered a return of 6.5%. Both results would have lagged market-timing investors benefitting from look-ahead bias. The bigger point to note is that all these returns underperformed a buy-and-hold portfolio.

Other Variables

Academics and practitioners have used other market return predictors. Like CAPE, most show a strong predictive performance in the full-sample data. However, the gist of our results is the same—an investor interested in forecasting next year’s return would do just as well using the historical average than any of the long list of possible predictors and technical regression tools.

Recent evidence shows that some technical predictors and/or combination forecasts might provide even better forecasting power.4 However, the jury is still out. Of course, researchers and investors can cherry pick models—intentionally or unintentionally. One could explore more variables and/or more sophisticated models. But such explorations aggravate the problems arising from (collective) specification search because some of models are bound to work by pure chance.5

Bottom Line

Market timing holds tremendous allure, and the investment profession has devoted considerable resources to discovering variables and models to predict market returns. However, we have yet to find a variable with meaningful, robust empirical equity premium forecasting power—at least from the perspective of a real-world investor. In the absence of this evidence, we recommend investors stay away from market timing and focus instead on the more important tasks of asset allocation and systematic investing.

GLOSSARY

Dow Jones Industrial Average. An average made up of 30 blue-chip stocks that trade daily on the New York Stock Exchange.

Full faith and credit pledge. The unconditional commitment to pay principal and interest on debt, usually guaranteed by a government entity (e.g., the U.S. Treasury).

Option. A financial contract between two parties that gives the buyer the right, but not the obligation, to buy or sell an asset or instrument at a specified price on or before a specified date. The seller has the corresponding obligation to fulfill the transaction if the buyer exercises the option. A put option contract gives the owner the right, but not the obligation, to sell, or sell short, a specified amount of an underlying security at a pre-determined price within a specified time frame.

Price to earnings ratio (P/E). The price of a stock divided by its annual earnings per share. These earnings can be historical or forward looking. Cyclically adjusted price-to-earnings ratio (CAPE) is the ratio of current price to a moving 10-year average of earnings. A P/E ratio allows analysts to compare stocks based on how much an investor is paying (in terms of price) for a dollar of earnings. Higher P/E ratios imply that a stock's earnings are valued more highly.

S & P 500® Index. The S&P 500® Index is composed of 500 selected common stocks most of which are listed on the New York Stock Exchange. It is not an investment product available for purchase.

U.S. Treasury Securities. Debt securities issued by the U.S. Treasury and backed by the direct "full faith and credit" pledge of the U.S. government. Treasury securities include bills (maturing in one year or less), notes (maturing in 2-10 years) and bonds (maturing in more than 10 years). They are generally considered among the highest quality and most liquid securities in the world.

ENDNOTES

1U.S. stocks represented by Shiller Composite S&P 500® data. Center for Research in Security Prices.

2 Shiller Composite S&P 500® data. Center for Research in Security Prices.

3 Welch, Ivo and Amit Goyal. 2008. “A Comprehensive Look at the Empirical Performance of Equity Premium Prediction.” The Review of Financial Studies 21, no. 4 (July): 1455–1508. https://doi.org/10.1093/rfs/hhm014

4 Neely, Christopher J., David E. Rapach, Jun Tu, and Guofu Zhou. 2014. “Forecasting the Equity Risk Premium: The Role of Technical Indicators.” Management Science 60, no. 7 (July): 1772-1791.

5 Harvey, Campbell R. 2017. “The Scientific Outlook in Financial Economics.” The Journal of Finance 72, no. 4 (August): 1399-1440.

Past performance is no indication as to future performance and the value of any investment may fall as well as rise. Any investment is done at the investor’s own risk.

Diversification does not assure a profit nor does it protect against loss of principal.

The opinions expressed are those of the investment portfolio team and are no guarantee of the future performance of any Avantis Investors portfolio.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

The information in this document does not represent a recommendation to buy, sell or hold a security. The trading techniques offered in this report do not guarantee best execution or pricing.

The contents of this Avantis Investors presentation are protected by applicable copyright and trade laws. No permission is granted to copy, redistribute, modify, post or frame any text, graphics, images, trademarks, designs or logos.