Can Financial Mindfulness Help Enhance Outcomes with Money?

What do you think of when you hear the term “mindfulness”? For me, it’s an iconic image of Don Draper in the final season of the TV series “Mad Men.” The scene presents a lesson in contrasts: Draper, wearing a crisp white button-down, sits cross-legged on the ground with the Northern Californian coastline behind him and a peaceful grin across his face.

He’s both quiet and aware. To be honest, this comes close to the definition of mindfulness. The American Psychological Association defines it as “awareness of one’s internal states and surroundings … [it] can help people avoid destructive or automatic habits and responses by learning to observe their thoughts, emotions, and other present-moment experiences without judging or reacting to them.”

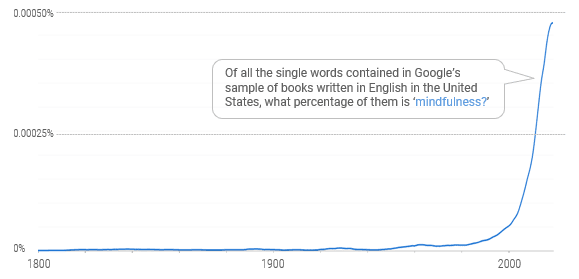

Mindfulness is having a moment. Check out Figure 1 to get an objective picture of how much more frequently people discuss mindfulness these days than a few decades ago.

Figure 1 | Mindfulness Has Surged in Popularity Since the 1990s

Data from 1800–2019. Source: Google Books Ngram Viewer, a web tool that tracks how often specific words and phrases appear in printed sources between 1500–2019.

I want to bring up mindfulness not because of its outrageous popularity in the corporate or wellness world but because of a recent focus on a related concept from the academic world. Specifically, a new working paper by Emily Garbinsky, Simon Blanchard and H. Lena Kim introduces the concept of financial mindfulness.¹ Admittedly, financial mindfulness has gained some popularity lately in certain segments of the financial services industry, but it lacks a robust definition and reliable way to measure it.

What Is Financial Mindfulness?

Consider again the definition for mindfulness — it’s an awareness of one’s body, thoughts and feelings without judgment. So, too, may it be the case for financial mindfulness. After reviewing relevant literature and conducting several interviews with everyday consumers, Professor Garbinsky and her colleagues define financial mindfulness as “the tendency to be highly aware of one’s objective financial state while possessing a non-judgmental acceptance of that state.” To this end, the definition contains two important components. First, a sense of financial awareness — knowing about your financial state — and second, a sense of “non-judgmental acceptance.”

Measuring Financial Mindfulness

Garbinsky and colleagues carefully developed an eight-item scale aimed at capturing both the awareness and acceptance components of financial wellness. For instance, one representative awareness item is “When I want to buy something, I know exactly how much money I have available to spend.” One representative acceptance item is “I cannot look at my credit or debit card statements without having my emotions take over” (that one is reverse-scored). I should note that the scale seems to capture something unique, as it’s statistically related to but also distinct from other related things like financial literacy and the propensity to plan.

Cultivating Financial Mindfulness Could Benefit Advisors and Clients

Elevated levels of financial mindfulness are related to a reduced likelihood of engaging in “financial withdrawal behaviors” (such as avoiding opening bills), impulse buying and the sunk cost bias (or the tendency to pay too much attention to sunk costs when making decisions about the future). Of course, Garbinsky and her co-authors simply measured financial wellness and didn’t try to manipulate or alter it.

But I couldn’t help but wonder: Just as people can practice mindfulness meditation to enhance their ability to attend to the present, could they practice techniques aimed at enhancing levels of financial mindfulness? Could doing so help consumers do more things they say they want to do with their money? Academics and advisors try to create interventions that help people think more carefully about their saving, spending, budgeting and so on. Might a better strategy — that is, a more indirect strategy — be one that enhances clients’ sense of financial mindfulness?

Beyond these important applications, there’s another reason that I wanted to talk about this topic here. Financial mindfulness was first noticed by folks in the financial services industry, who most likely figured that the practice of mindfulness could apply to money management as well. Yet, the application was done in an unstructured way, which is why Garbinsky and colleagues’ research is so welcome.

With any luck, this academic work will make its way back to the world of financial advisors, planners and wealth managers and enrich discussions with clients. But this journey is a rare one. Too often, topics that are important to practitioners are less so to academics, and ideas that are the focus of thousands of academic journal pages remain unknown to industry leaders. Lamentably, silos exist between industry and academia when perhaps they shouldn’t.

Recently, I’ve begun an effort aimed at bridging this gap. Together with the folks at Avantis Investors®, we have launched a podcast called “The Behavioral Divide.” Each episode will feature an academic talking about their work and one or two financial advisors talking about how the work applies (or doesn’t!) to their practices. The first episode features a discussion of well-being, and although financial mindfulness isn’t discussed, it certainly could have been.

So, I’m curious: Which topics from the advisory world should be better studied in academia? And which academic topics haven’t made enough of a dent in advisory practice? Please drop me a note at [email protected] to let me know. After all, viewing important topics from multiple lenses can only strengthen our knowledge of them.

ENDNOTES

¹Emily Garbinsky, Simon J. Blanchard and H. Lena Kim, “Financial Mindfulness,” Georgetown McDonough School of Business Research Paper Forthcoming, September 6, 2023. Available at SSRN.

The opinions expressed are not necessarily those of Avantis® Investors. This information is for educational purposes only and is not intended as investment advice.

The contents of this Avantis® Investors presentation are protected by applicable copyright and trade laws. No permission is granted to copy, redistribute, modify, post or frame any text, graphics, images, trademarks, designs or logos.