It’s Been a Whale of a Year

Key Takeaways

The S&P 500® Index achieved a 25% return in 2024, marking the best two-year period in over 20 years.

Economic uncertainties and geopolitical tensions challenged investors in 2024.

Maintaining a long-term focus proved beneficial for investors in 2024.

After a 26% total return from the S&P 500® Index in 2023, few predicted 2024 would deliver another big year of gains for U.S. stocks. But it did.

Not only did the S&P 500 post a 25% return for the year, but the index reached 61 new all-time highs. Together, 2023 and 2024 form the best two-year period for U.S. stocks since the late 1990s.

Market Highlights and Sector Performance

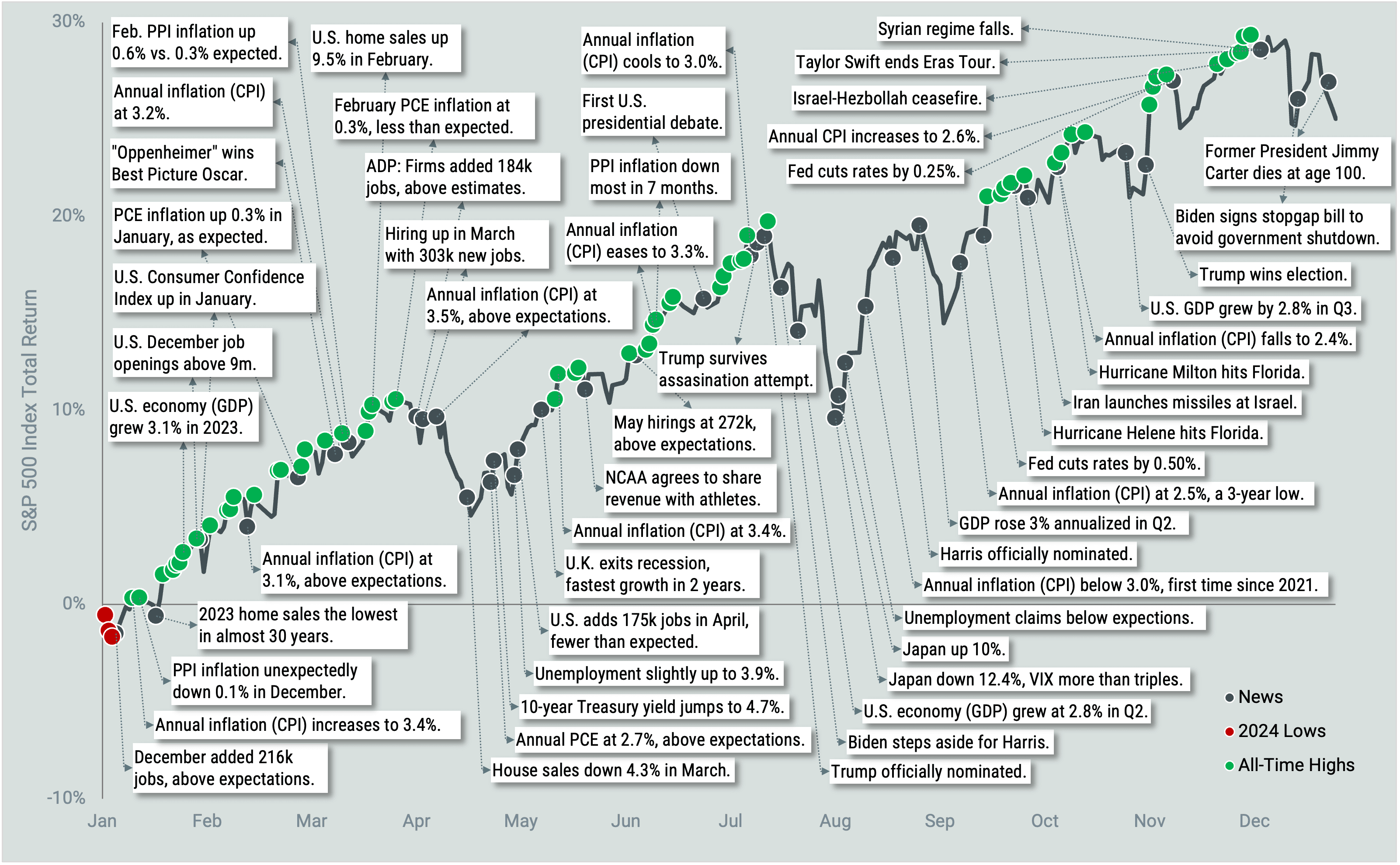

That’s great news for investors, but it just scratches the surface of their experience throughout 2024. Figure 1 provides additional perspective, complete with the full-year cumulative return of the S&P 500 and various market, economic and pop culture headlines.

This illustration reminds us of how economic uncertainties, the November election, geopolitical tensions and other factors challenged investors. Even those all-time market highs likely contributed to anxiety, as some investors fear they indicate a possible correction ahead. Ultimately, we believe the year provided a lesson in maintaining discipline and a long-term focus.

Figure 1 | S&P 500 Index Return and Headlines in 2024

Data from 1/1/2024 - 12/31/2024. Source: FactSet, Avantis Investors. Past performance is no guarantee of future results.

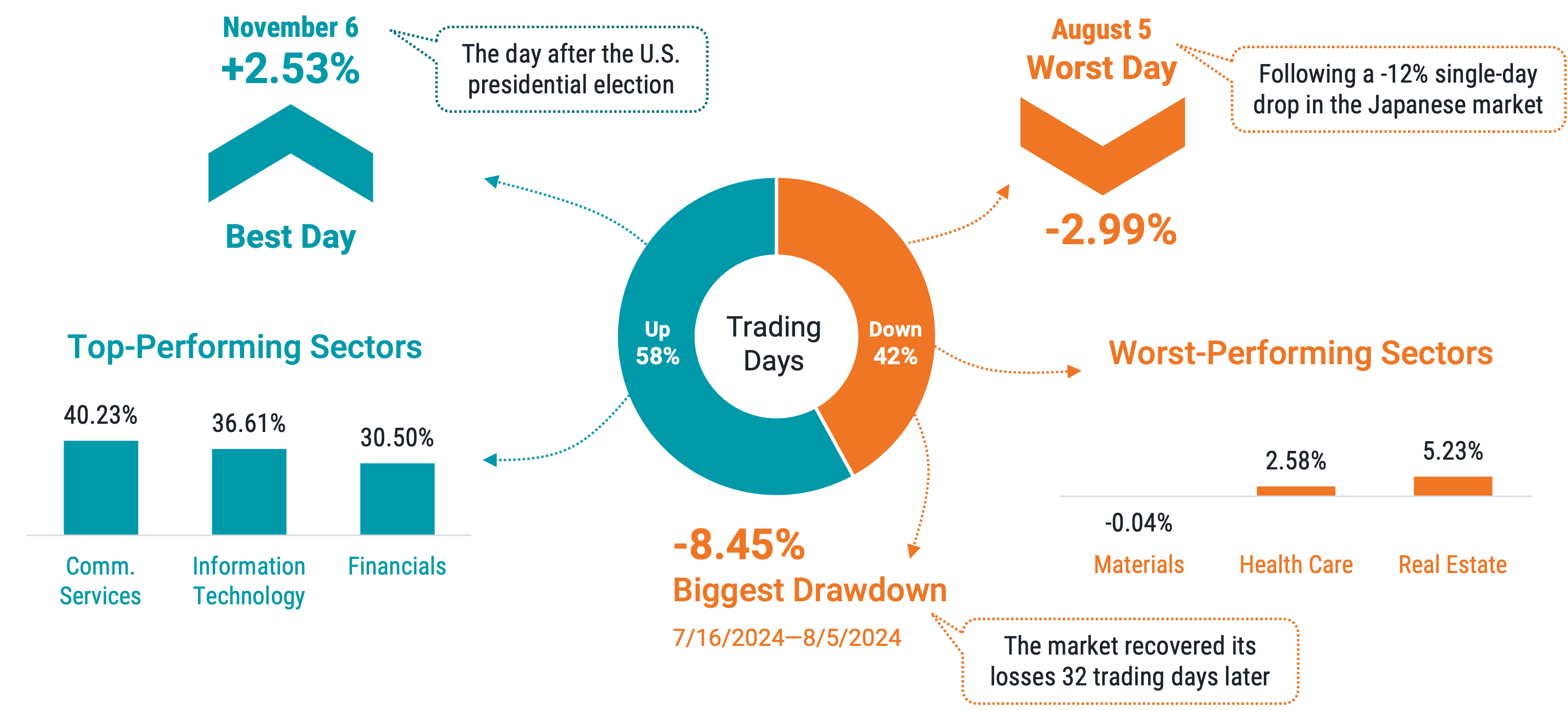

Figure 2 provides a deeper look into the numbers behind the market in 2024. As you might expect, U.S. stocks had more up days than down days, and some days were better than others, while some days weren’t great at all.

Not all companies or sectors in the S&P contributed equally to the strong results. While returns were positive for all but one sector on the year, there was wide dispersion among them. Communication Services was the top-performing sector, besting materials stocks, the lowest performer, by more than 40%.

Figure 2 | S&P 500 Index by the Numbers in 2024

Data from 1/1/2024 - 12/31/2024. Source: Bloomberg, Avantis Investors. Past performance is no guarantee of future results.

Economic Indicators and Federal Reserve Actions

The U.S. economic and interest rate picture also remained in focus for investors in 2024. We came into the year with indications that the Federal Reserve (Fed) would likely begin cutting rates before the end of the year. This finally became a reality with a 0.50% cut to the federal funds rate in September. Quarter-point cuts followed in November and December, bringing the target rate to a range of 4.25% to 4.50% at the close of the year, down from 5.25% to 5.50% at the start.

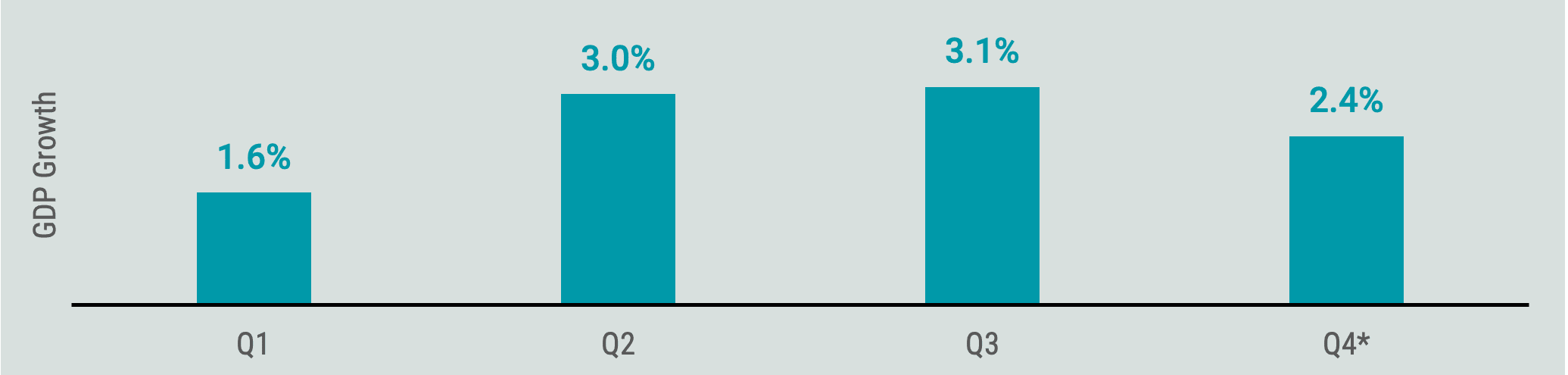

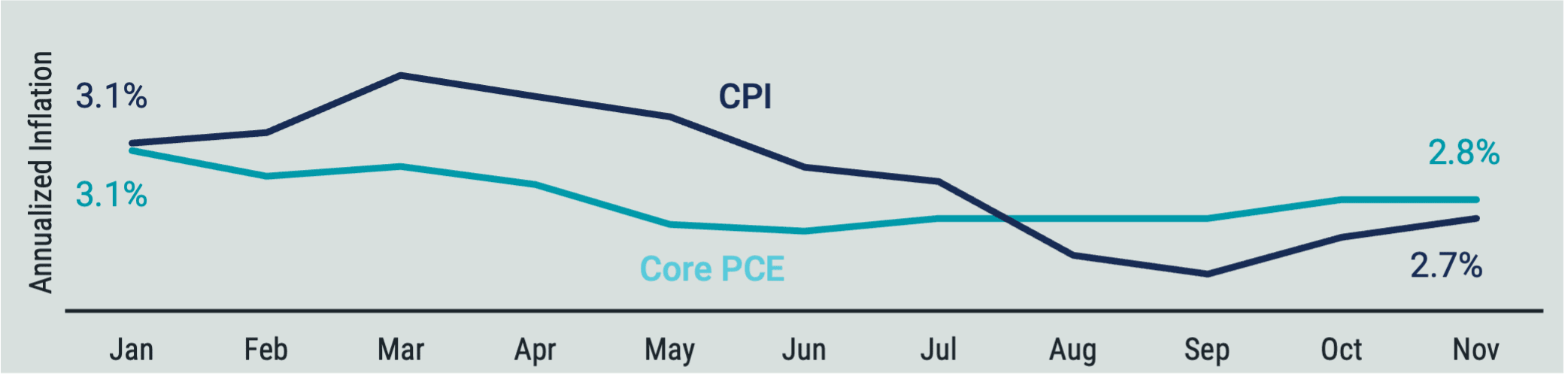

Figure 3 summarizes some of the most watched economic metrics in 2024. The key takeaway is that while much discourse surrounded month-to-month changes in unemployment and inflation, the U.S. economy closed 2024 on solid ground. Inflation still sits closer to the Fed’s 2% target than a year ago.

Figure 3 | The U.S. Economy Was Resilient, Yet Again, in 2024

Source: U.S. Bureau of Economic Analysis. *Estimate from Atlanta Fed GDPNow as of 12/24/2024.

Source: FRED. Data from 1/1/1948 - 11/30/2024.

Source: U.S. Bureau of Labor Statistics. Data from 1/1/2024 - 11/30/2024.

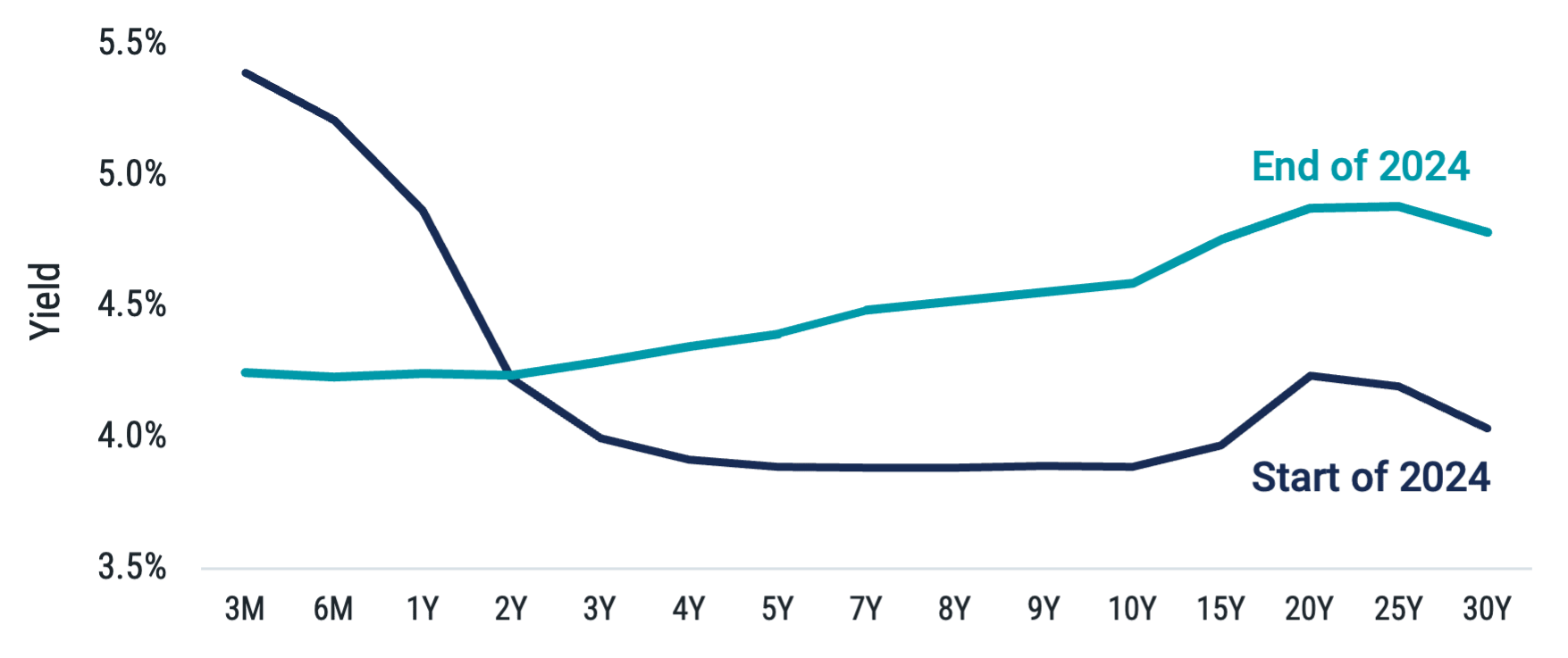

And how did the bond market react to all this news in 2024? In terms of performance, returns of the Bloomberg U.S. Aggregate Bond Index, a common proxy for the total U.S. bond market, were positive but modest in magnitude compared to stocks, at about 1.25% on the year. The real story was the dramatic change in U.S. yield curves and its implications for investors going forward.

Coming into 2024, the U.S. Treasury curve had been inverted since April 2022 when the yield on 10-year maturity Treasury bonds first became lower than the yield on shorter-maturity, two-year Treasuries. This contrasts with a “normal” yield curve when yields increase with longer bond maturities. In other words, you earn a higher yield for investing in bonds that will take longer for your principal investment to be returned.

As short-term rates rose behind Fed rate hikes throughout 2022 and early 2023, investors could earn higher yields on very short-maturity bonds. Government money market funds became a popular choice for their relatively high yields with low risk. This environment held until around the time of the Fed's first rate cut in September. At that point, the more-than-two-year inversion period for the U.S. Treasury yield curve ended, and the shift toward normalization took hold.

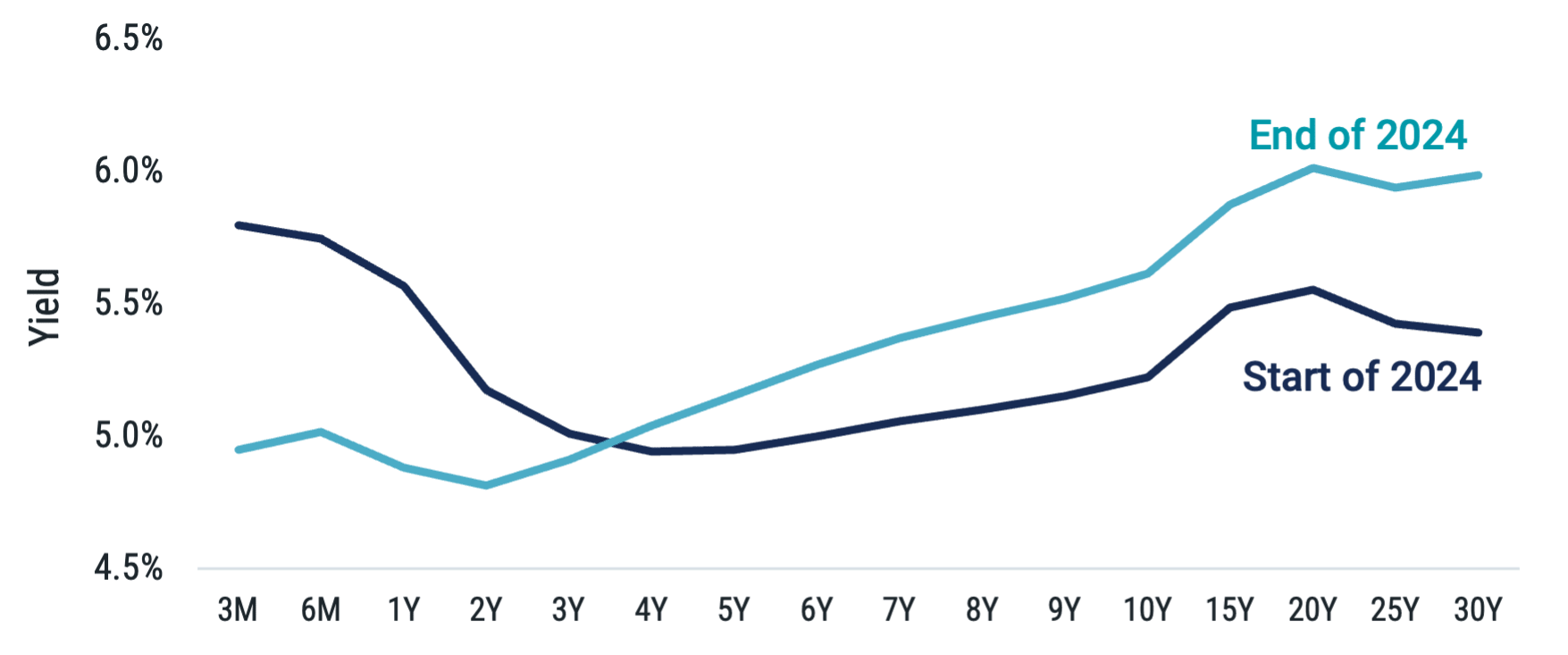

Figure 4 presents a snapshot of the U.S. Treasury curve at the start and end of 2024 (Panel A) and BBB-rated corporate bonds at the same dates (Panel B). The year-over-year change from inverted to normal is easy to see.

Figure 4 | Getting Back to Normal in 2024

Source: Bloomberg. Data from 12/31/2023 and 12/31/2024.

For investors today, this means that the interest that can be earned on short-term Treasuries and money market funds has declined. Higher yields can now be earned for extending duration (or buying out the curve to longer maturities). But that’s not all. With a normally shaped curve, extending duration also provides opportunities to take advantage of expected price appreciation (i.e., if bond yields go down as bonds mature, their prices will go up).

Some bonds across different sectors will have higher expected price appreciation and returns than others. Indexed bond funds simply buy the market without considering expected returns or diversification across issuers and issues, so there are opportunities for potential outperformance by taking these key considerations into account.

Preparing for Market Uncertainties in 2025

In many respects, 2024 was a tremendous year for investors. Does that mean we enter 2025 without uncertainties or potential anxieties? Hardly so. The truth is that investors always face uncertainty. It comes with the territory, but that doesn’t necessitate a bad investment experience if you stay disciplined.

Think back to the start of 2024. There were plenty of reasons then to doubt stocks' performance in the year ahead, but those who stayed invested throughout the year were rewarded with a handsome return.

Of course, not every year will be so kind. Go back to 2022, a year when the S&P 500 ended down nearly 20%. Investors endured some pain that year, but those who continued to stick with the market earned that back and more in the years that followed. Staying the course paid off, as is often the case over time.

So, who knows where 2025 will take us, but if we’re betting on anything, it’s hanging on to sound, old-fashioned investment principles like broad diversification and a long-term outlook. Their benefits are as certain as you can get when investing for a better future.

Explore More Insights

Glossary

Bloomberg U.S. Aggregate Bond Index: Represents securities that are taxable, registered with the Securities and Exchange Commission, and U.S. dollar-denominated. The index covers the U.S. investment-grade fixed-rate bond market, with index components for government and corporate securities, mortgage pass-through securities and asset-backed securities.

Consumer Price Index (CPI): CPI is a U.S. government (Bureau of Labor Statistics) index derived from detailed consumer spending information. Headline CPI measures price changes in a market basket of consumer goods and services such as gas, food, clothing, and cars. Core CPI excludes food and energy prices, which tend to be volatile.

Duration: Measures how long it takes, in years, for an investor to be repaid a bond’s price by the bond’s total cash flows. It is also a measure of a bond’s interest rate sensitivity. The longer the duration, the more sensitive a bond is to interest rate shifts.

Expected Returns: Valuation theory shows that the expected return of a stock is a function of its current price, its book equity (assets minus liabilities) and expected future profits, and that the expected return of a bond is a function of its current yield and its expected capital appreciation (depreciation). We use information in current market prices and company financials to identify differences in expected returns among securities, seeking to overweight securities with higher expected returns based on this current market information. Actual returns may be different than expected returns, and there is no guarantee that the strategy will be successful.

Federal Funds Rate: An overnight interest rate banks charge each other for loans. More specifically, it's the interest rate charged by banks with excess reserves at a Federal Reserve district bank to banks needing overnight loans to meet reserve requirements. It's an interest rate that's mentioned frequently within the context of the Federal Reserve's interest rate policies. The Federal Reserve's Open Market Committee sets a target for the federal funds rate (which is a key benchmark for all short-term interest rates, especially in the money markets), which it then supports/strives for with its open market operations (buying or selling government securities).

Federal Reserve (Fed): The Fed is the U.S. central bank, responsible for monetary policies affecting the U.S. financial system and the economy.

Gross Domestic Product (GDP): A measure of the total economic output in goods and services for an economy.

Inverted Yield Curve: An interest rate environment in which long-term debt instruments have a lower yield than short-term debt instruments of the same credit quality.

Money Market Mutual Funds: These funds invest in short-term debt instruments (e.g., commercial paper, U.S. Treasury bills, repurchase agreements) and are valued for their relative safety and liquidity.

Personal Consumption Expenditures (PCE): The PCE price deflator — which comes from the Bureau of Economic Analysis' quarterly report on U.S. gross domestic product — is based on a survey of businesses and is intended to capture the price changes in all final goods, no matter the purchaser. Because of its broader scope and certain differences in the methodology used to calculate the PCE price index, the Federal Reserve holds the PCE deflator as its preferred, consistent measure of inflation over time. Core PCE is a narrower measure of consumer spending that excludes food and energy prices in order to achieve a better indicator of long-term inflation trends.

S&P 500® Index: A market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The index is widely regarded as the best gauge of large-cap U.S. equities.

Treasury Yield: The yield of a Treasury security (most often refers to U.S. Treasury securities issued by the U.S. government).

U.S. Treasury securities: Debt securities issued by the U.S. Treasury and backed by the direct “full faith and credit” of the U.S. government. Treasury securities include bills (maturing in one year or less), notes (maturing in two to 10 years) and bonds (maturing in more than 10 years).

Yield: The rate of return for bonds and other fixed-income securities. Price and yield are inversely related: As the price of a bond goes up, its yield goes down, and vice versa.

Yield curve: A line graph showing the yields of fixed income securities from a single sector (such as Treasuries or municipals) but from a range of different maturities (typically three months to 30 years) at a single point in time (often at month-, quarter- or year-end). Maturities are plotted on the x-axis of the graph, and yields are plotted on the y-axis. The resulting line is a key bond market benchmark and a leading economic indicator.

Diversification does not assure a profit nor does it protect against loss of principal.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

The opinions expressed are those of the portfolio team and are no guarantee of the future performance of any Avantis fund.

The letter ratings indicate the credit worthiness of the underlying bonds in the portfolio and generally range from AAA (highest) to D (lowest).

Generally, as interest rates rise, the value of the bonds held in the fund will decline. The opposite is true when interest rates decline.

Contact Avantis Investors

inquiries@avantisinvestors.com

This website is intended for Institutional and Professional Investors, not Retail Investors.